OPENING COMMENTS

Ag Fundamentals: New crop corn endings stocks were reported at the bottom of the estimate range, at 1.8 billion bushels. That is a bold statement from the USDA about demand for the coming year seeing they are projecting a 15.8 million bushel corn production in the US. 95.3 million acres is the most corn planted in over 10 years. Corn prices are lower this morning as doubt creeps in about the bullish report yesterday, down over 3¢ at the pause. Soybeans rallied off the US/China trade cooler news from Sunday and extended into the close as a neutral to slightly bullish report took away some headwind. Domestic crush was reported 70 million bushels higher for new crop soybeans, which lead the balance sheet to an overall increase of 31 million bushels for new crop demand. Winter wheat conditions improved overall, but dropped in South Dakota and Nebraska. Kansas, Texas and Oklahoma are the main three winter wheat producing states and they all improved. Russia is expected to lead in global wheat exports with the USDA estimating they will export 45 MMT in 25/26 vs. the 43.5 MMT 24/25. Wheat prices feeling the strength of the dollar index, still above 101.00 this morning.

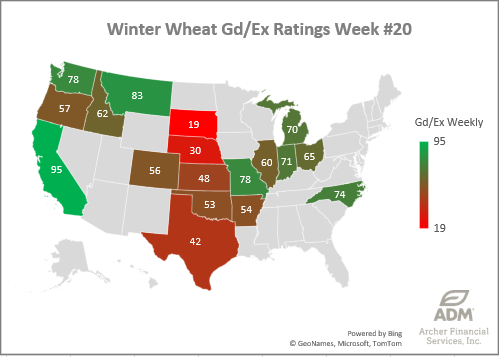

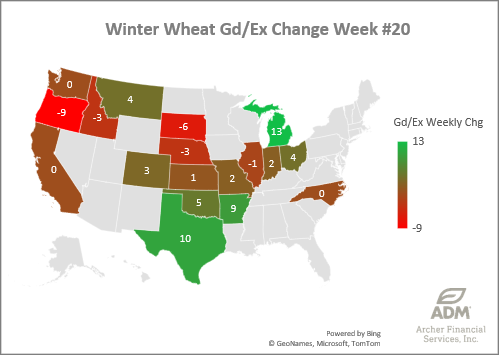

Winter Wheat Conditions +3%

Winter Wheat Conditions increased week-over-week from 51% to 54% good/excellent. South Dakota and Nebraska are the two states presenting the most concern for quality. Texas had a 10% improvement from last week’s ratings.

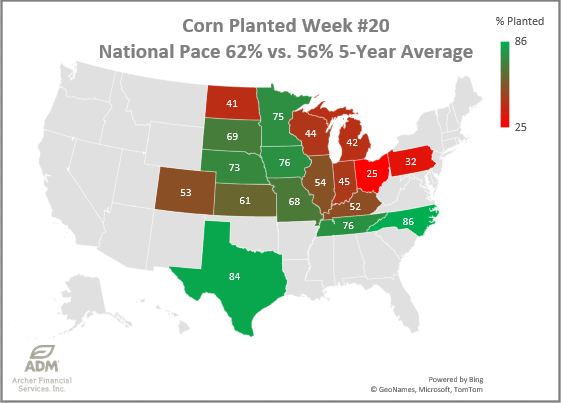

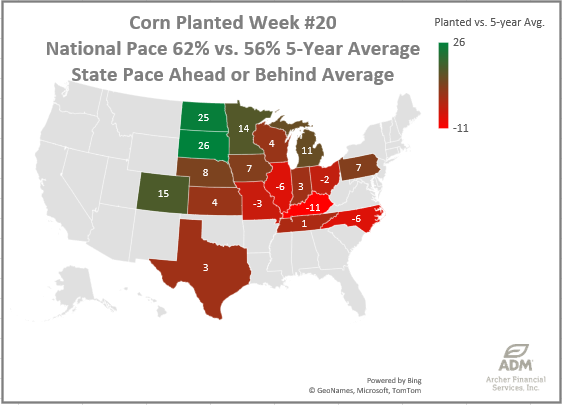

Corn Planting Progress 62%

Corn Planting is ahead of the 5-year national pace by 6%. There are some pockets of concerns in southern Illinois, Missouri, Kentucky, and Ohio but overall corn planting is going very well here in the US.

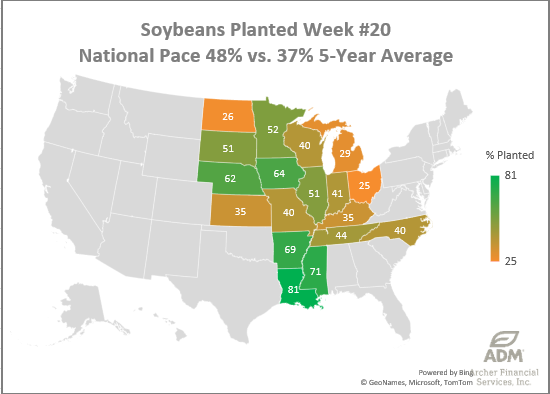

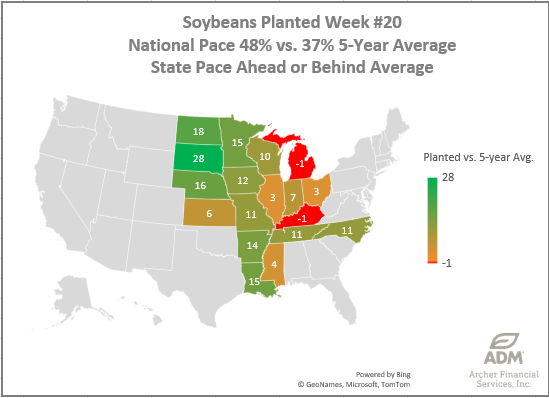

Soybeans Planting Progress 48%

Soybean Planting is 11% ahead of the national 5-year average pace. Kentucky and Michigan are the only two states behind schedule.

Export & World News

Algeria issued a new tender to purchase up to 320K MT of animal feed corn sourced from South America.

Malaysian palm oil futures were up 79 ringgit overnight, now at 3893.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.70 (expanded $1.05); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

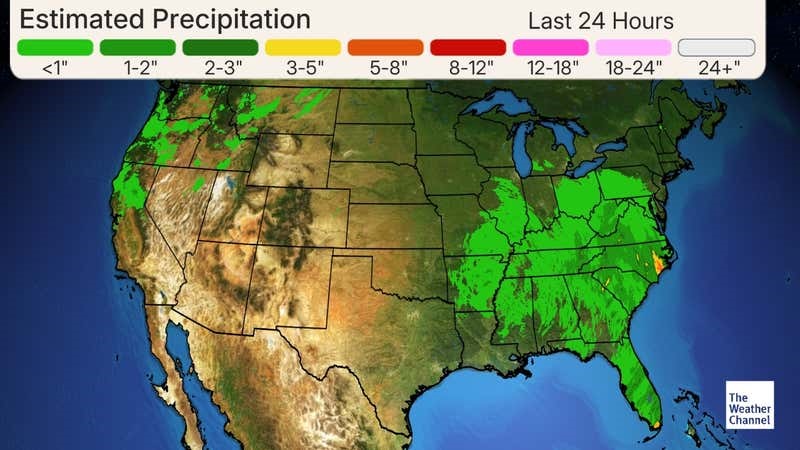

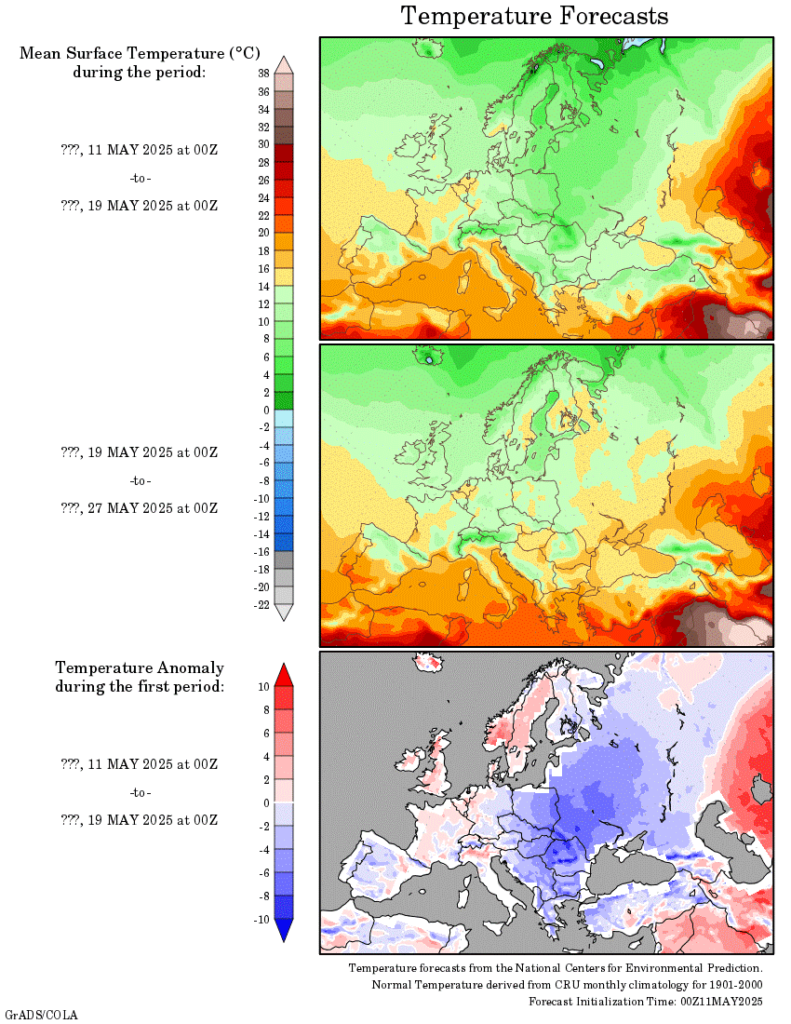

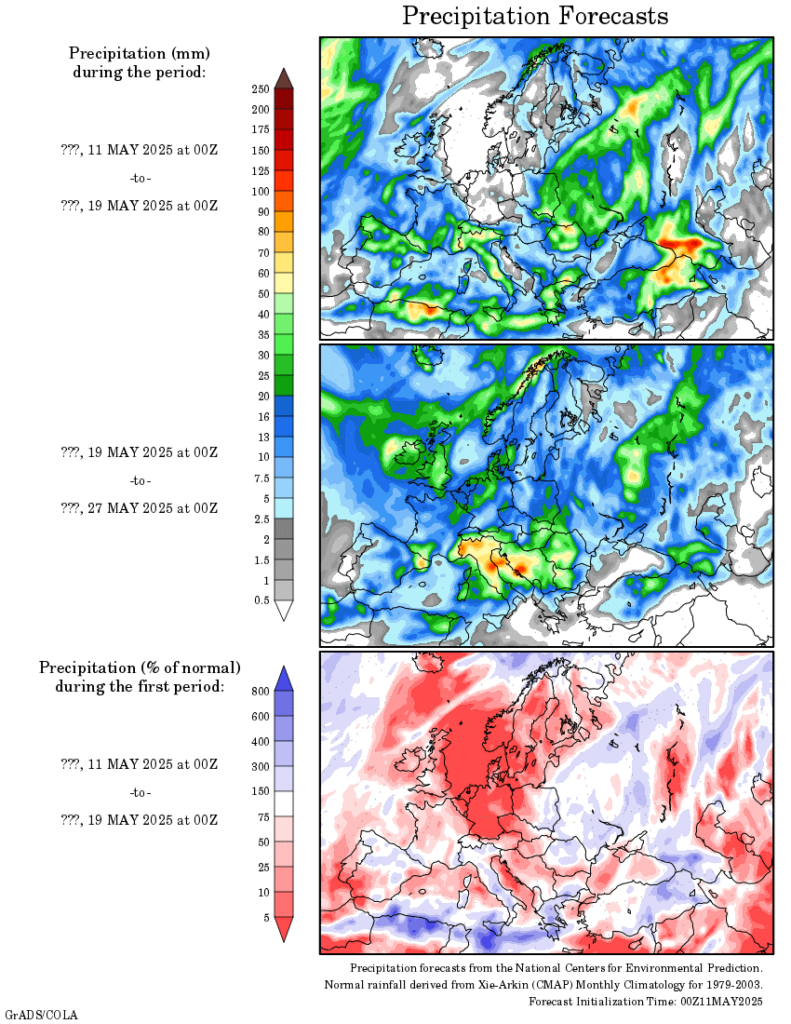

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.