OPENING COMMENTS

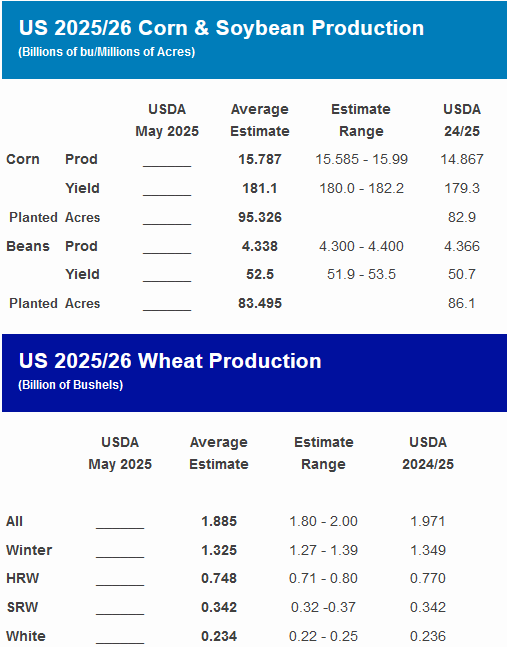

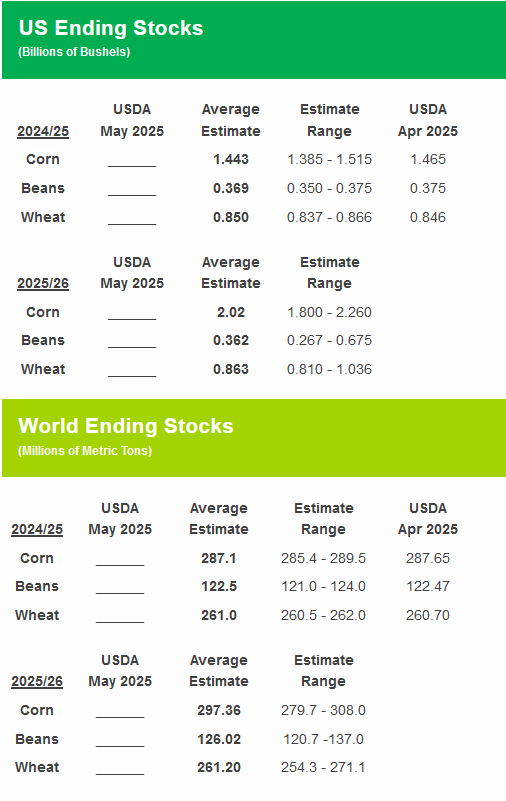

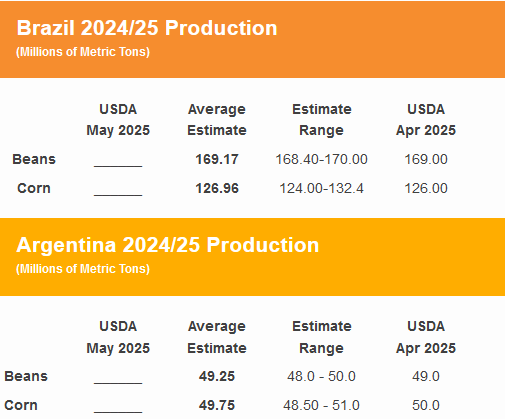

Ag Fundamentals: Tariffs between China and the US are suspended for 90 days. That puts a deadline for a new deal in mid-August, which is near the time of year China begins to focus their purchasing power toward US soybeans. Both Countries dropped their tariff rates 115%. The US took their rates from 145% to 30% (10% universal + 20% fentanyl-related tariff), and China dropped from 125% to 10% for the 90-day period. Soybeans rallied 16¢ overnight following the news of a pause. A US flash sale of 120K MT of soybeans to Mexico was reported this morning (24K MT for 24/25 marketing year and 96K MT for 25/26 marketing year). The USDA will release the May WASDE report today at 11:00am CST. Due to the timing of the 90-day pause and the market now assuming a trade deal will finalize before new crop is cut, many believe ag markets will remain supported today despite any bearish news the report may offer. The Commitment of Traders report on Friday afternoon (shown below) had managed money mostly sellers apart from Chicago wheat and canola. Currencies are in focus as the news broke of a trade deal between China and the US. The dollar surged to test 102.0 on the index and all other global currencies are red this morning.

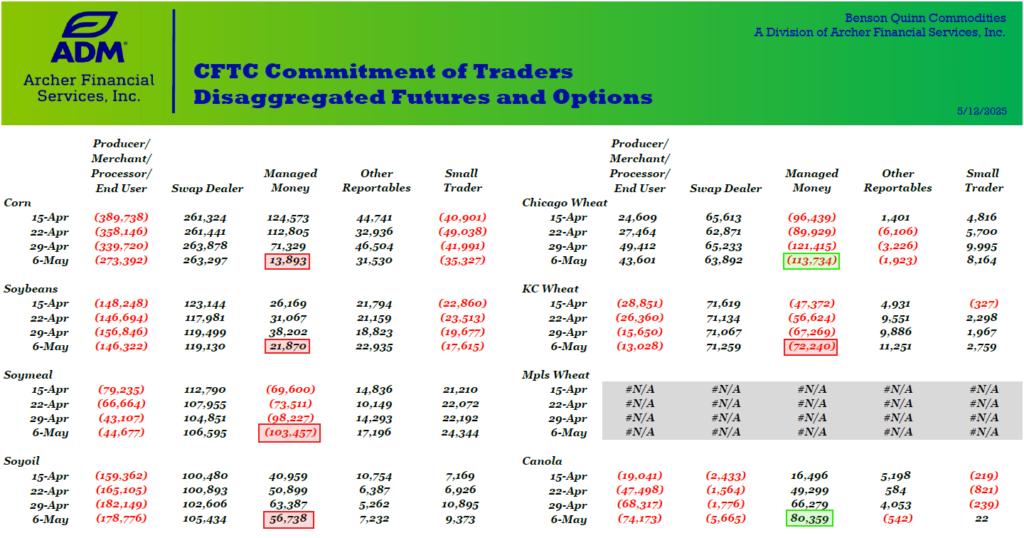

The CFTC Commitment of Traders Report

Change in Managed Money Positions

Corn: -57,436

Soybeans: -16,332

Soybean Oil: -6,649

Soybean Meal: -5,230

Chi Wheat: +7,681

KC Wheat: -4,971

Canola: +14,080

Export & World News

This Morning, The USDA reported a 120K MT sale of soybeans to Mexico (24K Mt for 24/25 marketing year and 96K MT for 25/26 MY). Last week the USDA reported a sale of 288K MT of corn to Mexico (95K MT for 24/25 marketing year and 193K MT of 25/26 MY). The US also announced a sale of 120K MT of soybeans to Pakistan and 60K Mt of soybean meal to South Korea.

Malaysian palm oil futures are closed for holiday.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.70 (expanded $1.05); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

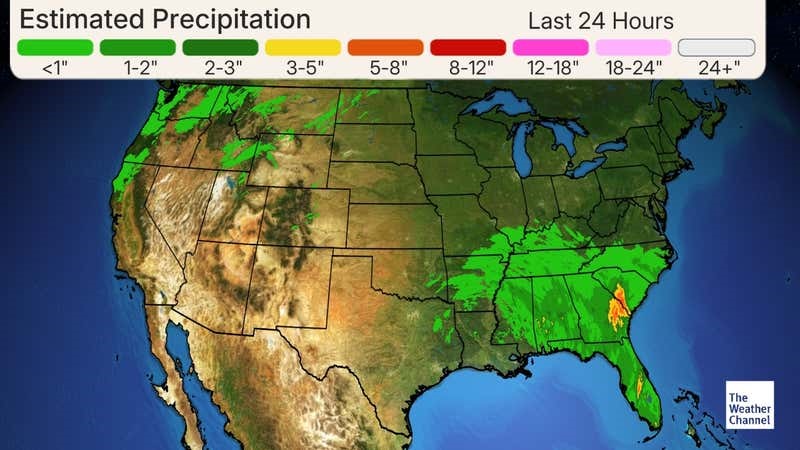

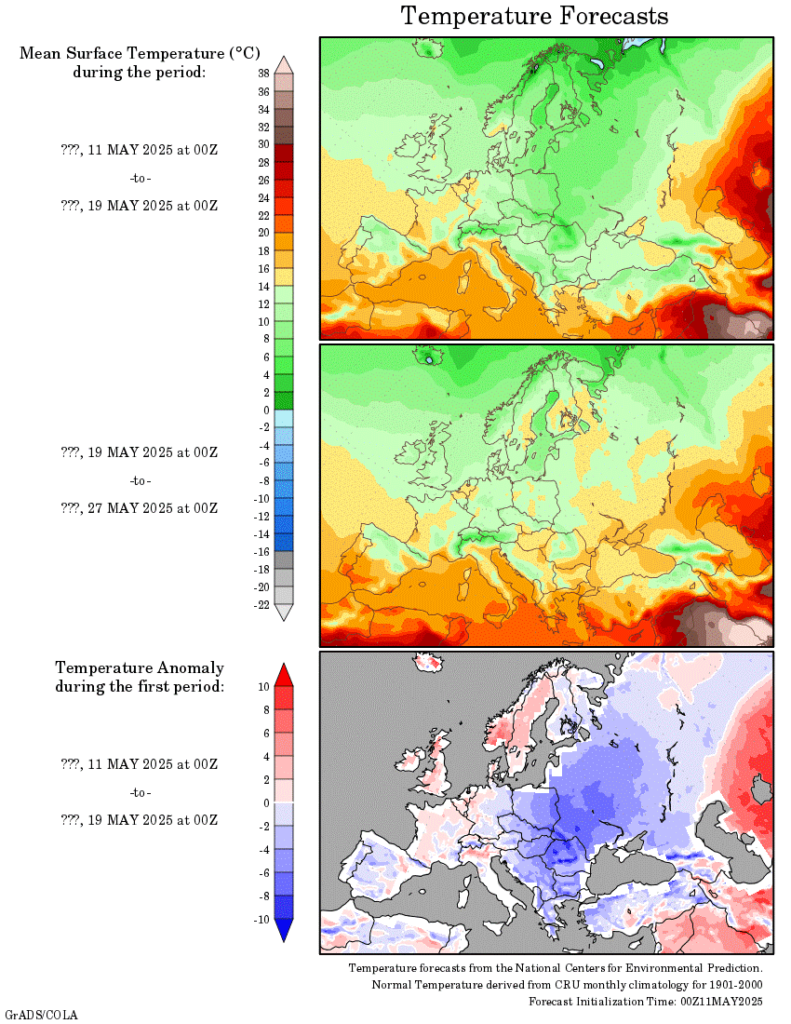

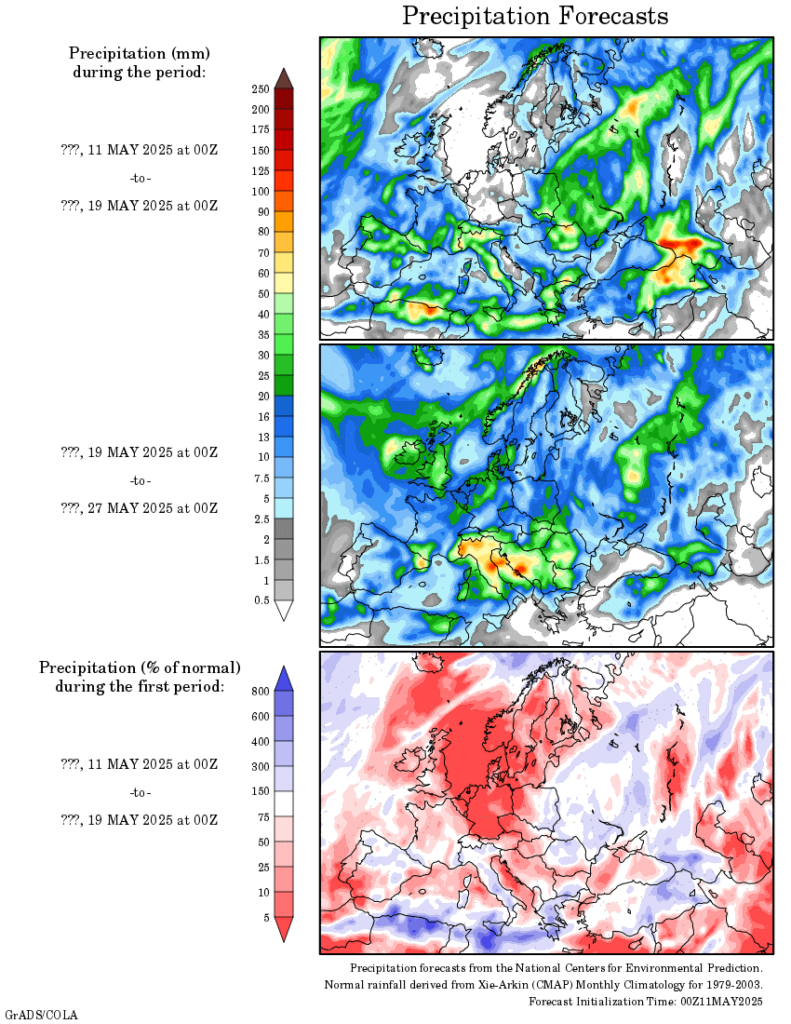

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.