MORNING COMMENTS

Geopolitics:

Russia is hosting a 3-day summit this week starting today. The summit will take place in Kazan and hosted by the BRICS group. BRICS stands for Brazil, Russia, India, China, and South Africa.They have recently expanded by adding Egypt, the United Arab Emirates, Ethiopia and Iran. Argentina was close to joining before their recent election. Turkey and Audi Arabia are looking to join as well. The leaders of 36 countries are meeting this week to strengthen ties and find common ground. Discussions around sanctions and the dominance of the US dollar in global affairs will take place along with how they can all work together to even the odds against the western powers.

Macroeconomics:

The IRS adjusts the income thresholds for individual tax brackets every year to account for inflation. This year the IRS adjusted brackets by 2.8% which is the smallest adjustment in several years. 2.8% adjustment for 2025 is in line with expectations. To compare the last couple years, the IRS adjusted 2024’s brackets +5.4% and 2023 was an adjustment of +7.1%. I included the bracket changes in a chart below.

Ag Fundamentals:

Row crops all higher on the board aside from an unchanged Minneapolis wheat close. Charts are attempting to establish support at a higher low than board prices in mid-August. Feeders are looking at corn cash prices below $4 which many would argue should be a buy. The activity in the spreads (mostly SX/SF bean spread) has more to do with domestic demand than anything. Processors around the country are attempting to run at full capacity while also trying to take advantage of a large crop filling on-farm space and forcing farmers to spot, lock in basis, or use a differed price program. They have increased bids for October delivery slightly but the board and spreads are having to do most of the lifting. Grain markets would like to see China step in into their typical purchasing slot, but their patience has rewarded them to this point so it is likely they will wait until mid November to move their next chess piece. No matter who is leading the country after November 5th, China will still have import volume as a bargaining chip. In order to buy time, China is hand to mouth. Brazil weather looks promising for a majority of the growing regions. Only a couple spots are expected to see dryness over the next 10-14 days.

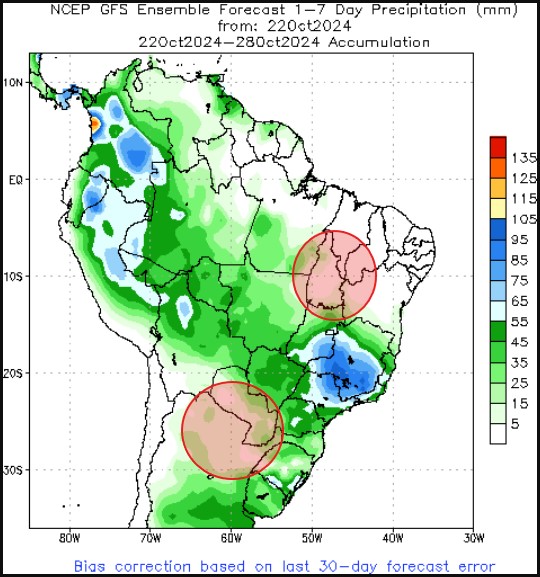

The 7-Day Total Precipitation Map has two dry spots circled in red below. The Production areas that are included in these circles can be seen in the images following.

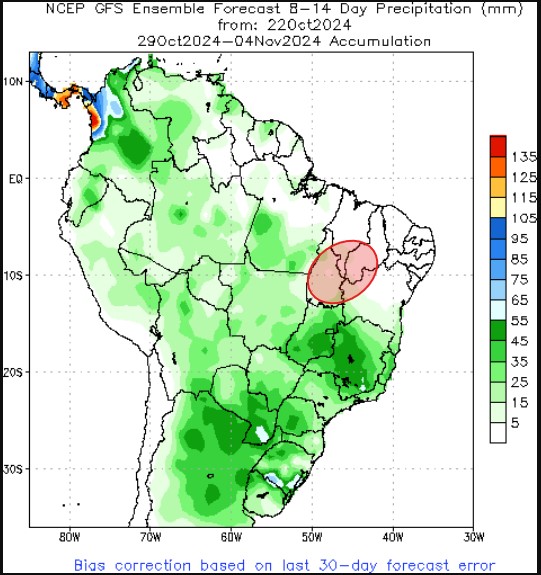

The 14-Day Total Precip Map has rains filling in some of the northern Argentina and Paraguay dry areas, but still has the northeast Brazilian growing regions absent of moisture.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -12 3/4 | +1 | -30 3/4 | 41% |

SX24/SF25 | -8 3/4 | 0 | -26 3/4 | 33% |

SX24/SN25 | -47 1/4 | 0 | -106 1/4 | 44% |

MWZ24/MWH25 | -21 1/2 | +1/2 | -30 3/4 | 70% |

WZ24/WH25 | -20 1/4 | – 1/4 | -24 1/4 | 84% |

KWZ24/KWH25 | -14 1/4 | +1/2 | -24 1/4 | 59% |

Cost of Carry

The SX/SF bean spread reached -6’2 during today’s trading session. As space squeezes tighter around the country, it will be easier for processors to receive spots, and take advantage of storage programs the rest of the month.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.