MORNING COMMENTS

Geopolitics:

The Pentagon issued a statement today that they can not confirm any North Korean troops are moving to aid Russian troops at this time. A claim that was made last week by Ukraine’s President Zelensky. Unconfirmed information about Israels plans to strike Iran may have leaked from the US pentagon as well. This information was leaked and made it’s way on pro-Iranian social media. Zelensky is convinced he is facing enemies from Iran, Russia and North Korea while Israel is facing adversaries on 7 fronts. Just keep a lid on the nukes. Question is, will the UN accept Ukraine and how involved will the US be if fighting in either area intensifies?

Macroeconomics:

This week’s economic data looks slightly boring on its cover, but some of the information that comes out this week will add depth or bring to light the soft landing narrative. My bet is most news will be relatively neutral until after the election and fed meeting November 7th. Wednesday we will see existing home sales and mortgage applications which may tell us the housing market is still in short supply and unaffordable for most. Thursday we will see new home sales and weekly jobless claims. I am interested to see what Boeing’s earnings report will say on Wednesday as their stock had one of the best days in a while after news announced Saturday of the strike ending soon.

Ag Fundamentals:

First notice day for November Soybeans will be Thursday November 31st. Longs will need to be out of their positions by the close of Wednesday the 30th. Option expiration is Friday November 1st. Open interest for November soybean options are the hottest for $10, $10.40 and $11 calls. Option expiration next Friday could put pressure on board values as traders exit those positions. Thinking about the election and the unknown price movement and likely volatility, a long straddle option strategy may be the most appropriate. A Long Straddle is long a call and long a put, and you would typically use this strategy if you anticipate a major move in values but were unsure of which direction.

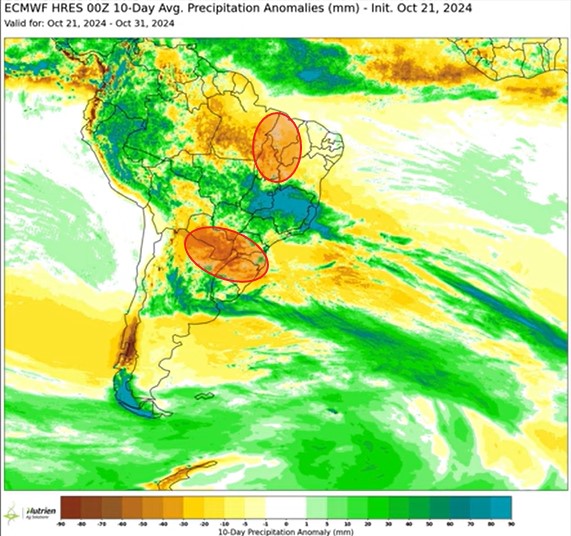

The 10-Day Precipitation Anomaly Map is showing above normal rainfall in the majority of South America’s growing areas. The Areas circled in red are at risk of drier than normal rainfall.

The True Size of South America Perspective is accurately illustrated below. It is good to keep in mind the absolute massive area that the market discusses regarding precipitation and planting progress.

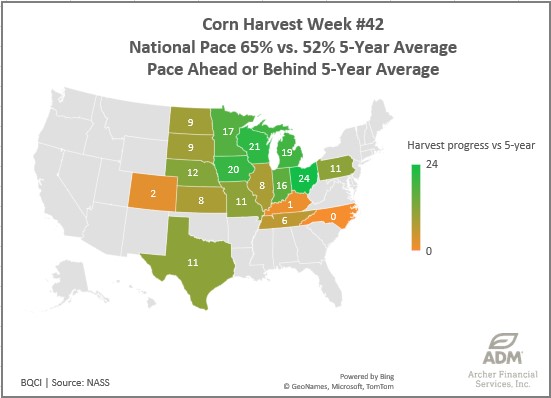

US HARVEST PROGRESS

Corn Harvest Progress up 18% from last week, 10% further along than is time last year and 13% quicker than the 5 year average. The American farmer has proven yet again they have the grit to accomplish incredible goals when weather allows. It would not surprise me if this year is named “The Perfect Harvest”.

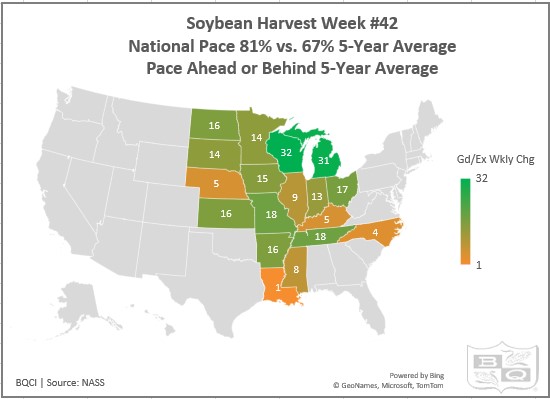

Soybean Harvest Progress is 14% closer to the finish line than last week, 9% more than this time last year and 14% higher than the average progress over the last 5 years. There is not a single state behind schedule.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -13 3/4 | +1/2 | -30 3/4 | 45% |

SX24/SF25 | -8 3/4 | +4 | -26 3/4 | 33% |

SX24/SN25 | -47 1/4 | +5 3/4 | -105 3/4 | 45% |

MWZ24/MWH25 | -22 | – 1/2 | -30 3/4 | 72% |

WZ24/WH25 | -20 | – 1/4 | -24 1/4 | 82% |

KWZ24/KWH25 | -14 3/4 | +1/4 | -24 1/4 | 61% |

Cost of Carry

Soybean Nov/Jan spread firms above last week’s highs. to -8’4 today, closing at -8’6. demand for the beans domestically is there, but increasing basis values and firming spreads may not cover the absent ownership over then next 20 days. Corn, we can expect the spread to hold a carry and possibly weaken as the rest of this year’s crop is shelled.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.