MORNING COMMENTS

Ag Fundamentals:

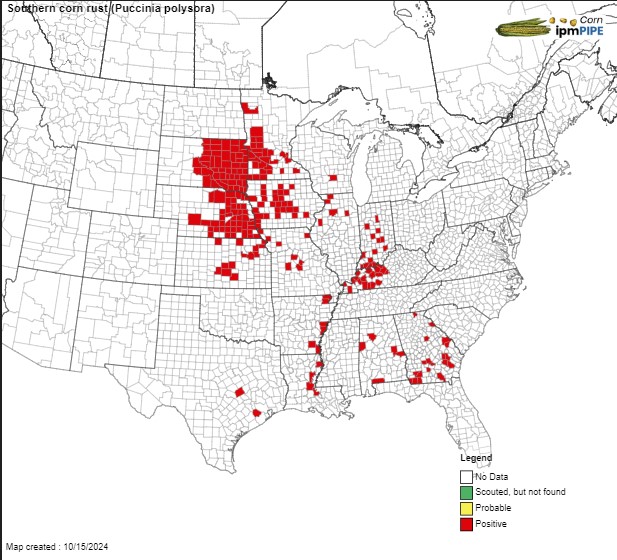

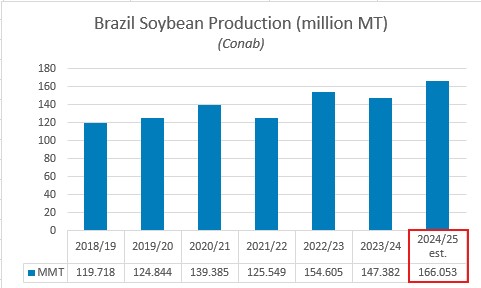

Conab released estimates for Brazil’s corn and soybean production for 24/25 crop year. Brazilian corn production was estimated at 119.7 million MT vs. the USDA’s 127 million MT estimate. Brazil and Argentina’s old crop corn exports were lowered but joined by an increase in domestic consumption. Conab’s Brazilian soybean production estimate came in at 166 million MT vs. the USDA’s 169 million MT. The late start to the soybean planting season in Brazil is not expected to effect yields at this time. As corn yields are further deliberated in the US it is important to note there were increasing positive cases of southern corn rust found from August-October in parts of eastern Nebraska, eastern South Dakota, Minnesota and Iowa. This may have been due to the abundant rain in the late spring and early summer clashing with a warm dry fall.

Weather:

The US experienced a mild 2023/2024 winter due to La Nina conditions allowing for warmer than normal temperatures and average to below average precipitation in major growing areas. This year climatologists are expecting conditions to lean into El Nino which could need a colder and wetter season. The consistency of storm activity in the heart of the US will depend on where high pressure forms in the northeast.

All Positive Cases of Southern Corn Rust from July-Oct 2024 |

Brazil’s Soybean Production Estimate is 12.7% greater than last year’s Brazilian soybean production.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -16 1/4 | +1/4 | -30 1/2 | 53% |

SX24/SF25 | -12 1/2 | +3 | -26 3/4 | 47% |

SX24/SN25 | -50 1/4 | +4 3/4 | -105 3/4 | 48% |

MWZ24/MWH25 | -21 3/4 | – 1/2 | -30 3/4 | 71% |

WZ24/WH25 | -21 1/4 | +3/4 | -24 1/4 | 88% |

KWZ24/KWH25 | -15 3/4 | +1/4 | -24 1/4 | 65% |

Cost of Carry

Bean processors only have a couple weeks of ownership and in order for grain to move nearby, the spreads are doing the work. There is still a lot of corn harvest to go because beans took the timely priority but once the rest of the corn crop comes off the spreads could leak out to a wider carry again.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.