MORNING COMMENTS

Macroeconomics:

This morning’s hotter than expected CPI report mixed with a higher than expected jobless claim number has many within the equities debating the Fed’s next move come November. The PPI will be out tomorrow morning at 7:30 am CST, which is equally as important to the central bank moving forward with further rate cuts. A 50 basis point cut may be too much following this last Fed action and I think no additional cut in November would send the market into a panic.

Ag Fundamentals:

The USDA WASDE report will release tomorrow at 11:00 am CST. Corn quarterly stocks were lower in the USDA’s late September report cutting into the corn supply. If corn yields are slightly lower and usage is a tick higher, then US corn ending stocks should come in below 2 billion bushels. US Ending stock estimates are between 1.835 and 2.1 billion bushels. The USDA still needs to account for the dry weather the majority of the US experienced since the last report was released on September 12th. I expect soybeans to be very close to the September WASDE report numbers. A production number over 4.6 billion bushels would be a record bean crop. As long as the USDA is not taking into account the low moisture values farmers have been clocking at the elevators in the last two weeks and they are focused on the crop conditions and early yield reports then bean yields should remain at or above 53.2 bpa and possibly closer to 53.5 bpa. Russian government officials have lowered their 2024 wheat production number from 84 MMT to 83 MMT. They had started this year’s estimates off at 88 MMT or better so they have dropped over 5% of their wheat production since earlier this summer.

Weather:

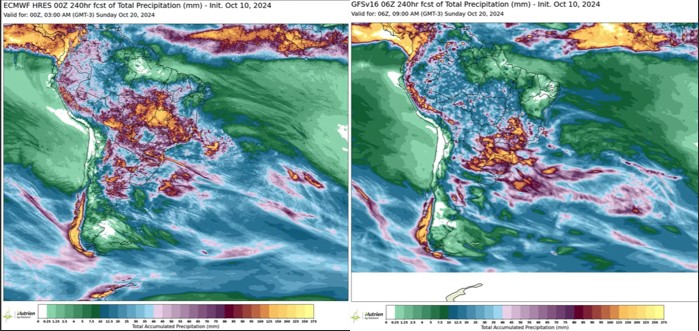

Expect normal temps and clear weather between now and Sunday in the US growing regions. Northeast Minnesota and Wisconsin may receive some rain relief over the weekend. Northern Illinois, Indiana and Ohio will see light showers Monday and Tuesday next week. Frost will hit the northern plains and parts of the eastern corn belt on Tuesday next week. The European and Global (GFS) forecast models are not in agreement about the rain in Brazil’s 10-day forecast. The European is much more bearish beans than the GFS.

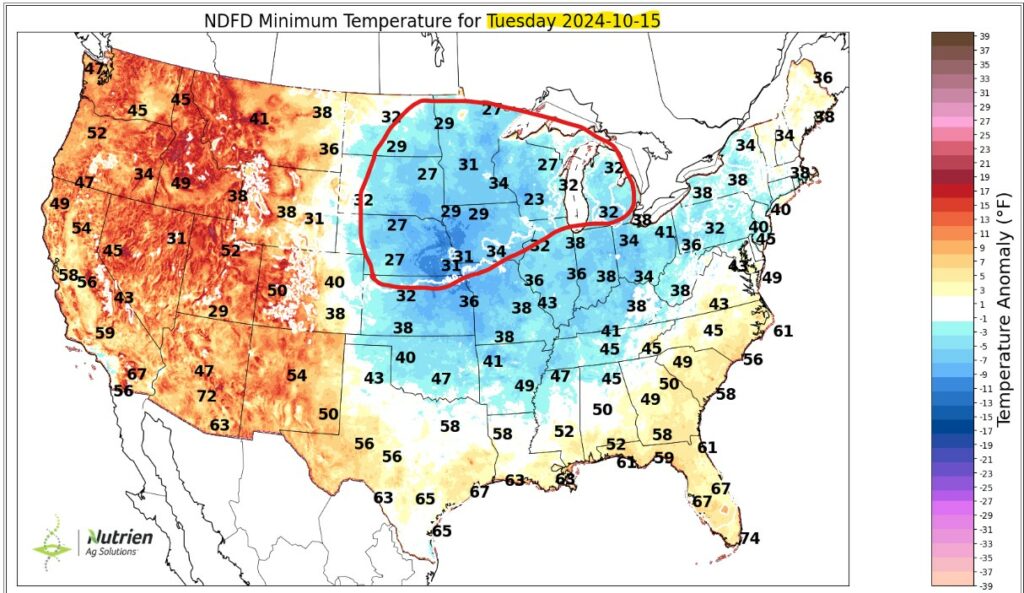

Tuesday October 15th Minimum Temps is showing the likelihood of frost in the area circled in red below. This is nothing new for this time of year, but could still effect crops exposed.

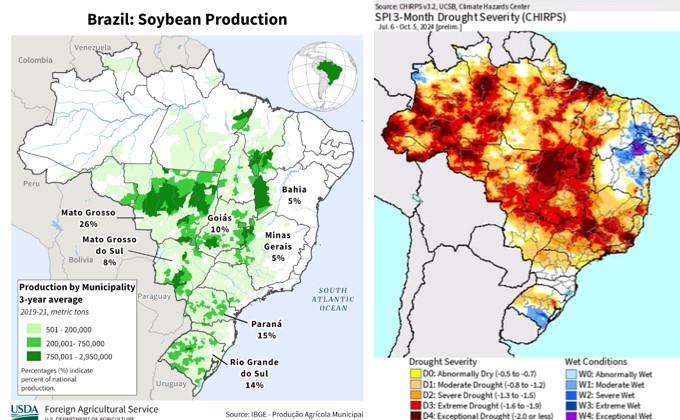

The SPI 3-Month Drought Severity Map shows eastern Mato Grosso, parts of Goias and southern western Minas Gerais are the most severely drought stricken regarding Brazil’s major soybean growing areas.

10- Day Total Rain – European (Left) vs. GFS (Right) is showing some contradictions in the 10-Day forecasts. European showing wetter conditions in the central Brazil, but the GFS does not have as much precip.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -17 3/4 | – 3/4 | -30 3/4 | 58% |

SX24/SF25 | -16 3/4 | 0 | -27 | 62% |

SX24/SN25 | -58 | -1 1/4 | -106 3/4 | 54% |

MWZ24/MWH25 | -20 3/4 | – 1/4 | -31 1/4 | 66% |

WZ24/WH25 | -22 3/4 | +1/2 | -24 1/2 | 93% |

KWZ24/KWH25 | -16 3/4 | – 1/2 | -24 3/4 | 68% |

Cost of Carry

Spreads weaker today most likely due to hedge pressure leading up to tomorrow’s WASDE report. Russian export pressure is keeping Chicago wheat firm nearby.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.