MORNING COMMENTS

Macroeconomics:

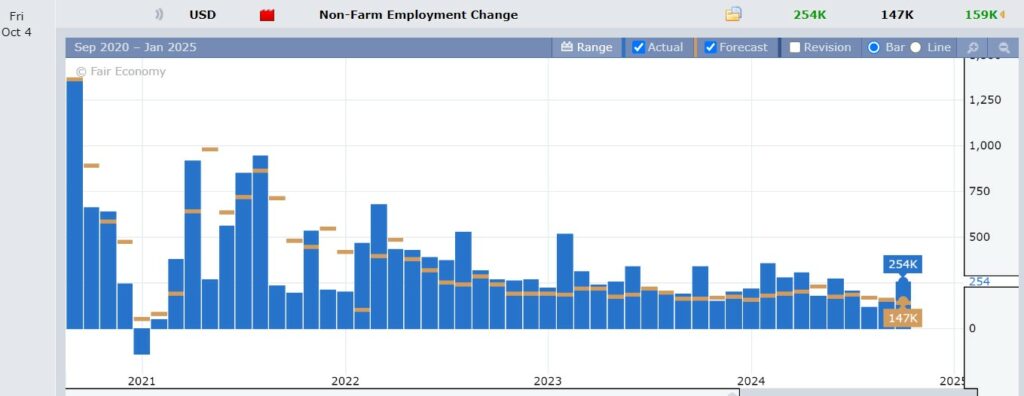

Jobs report coming in HOT. Estimates for this mornings report were forecasting an increase of 147K non-farm jobs, a 0.3% increase in hourly earnings and an unchanged unemployment rate at 4.2%. Instead the report blew estimates out of the water at 254K new non-farm jobs, 0.4% increase in hourly wages and unemployment came in lower at 4.1%. Unemployment is still the 3rd highest since January of 2022, only below the last two months. Could this influence Powell to rethink another 50 basis point cut on November 7th? On a separate note, the dockworker strike on the east coast has been temporarily suspended and the port workers agree to terms that extend their contract behold the election and holidays to mid January.

Ag Fundamentals:

Corn had a good week and trying to hold on, but it has had bullish news on the regular. Monday’s stock report showing an increase in feed and residual, higher than expected exports and talk of yields in the US needing a trim due to the dryness over the last couple months. We are still looking at a very large crop in the US. Harvest is chugging along and we could be setting a record pace on the amount of grain coming into the elevators this early. Soybeans are running low on moisture levels around the US, but that bullish news has been getting hit with forecasts of rain in central Brazil. It hasn’t rained down there yet, but they are expecting showers next Friday into the following week. Wheat is trying to hold onto it’s weekly gains from news of Russia possibly putting a restriction on exports as well as better than expected weekly exports.

Weather:

Rains are spread across most of northern Illinois today, giving farmers in that region a day of rest in the middle of what has been non-stop harvest. Parts of eastern Iowa and southern Wisconsin are also going to have to take most of the day off today as well. Most of the US is dry over the next 7 days.

Non-Farm Employment Change for this month was 107K jobs higher than the estimates. Estimate at 147K, report at 254K jobs.

Export & World News

Japan bought 137,000 MT food quality wheat from the US, Canada and Australia. Saudi Arabia is still looking for 295,000 MT of hard milling wheat.

Malaysian palm oil futures were up overnight 110 ringgit, at 4292.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.