MORNING COMMENTS

Geopolitics:

President Joe Biden spoke to the UN for the last time today in New York. The President talked about the world’s recovery from the covid pandemic and his exit from Afghanistan. He mentioned the many problems the world faces today including, war, climate change, keeping artificial intelligence under control, and democracy at risk. Biden then spoke about the effect of artificial intelligence on your way of life, work and war. He closed his comments by saying he stepped down from the presidential campaign because “some things are more important than staying in power”. In his opinion, it was for the betterment of democracy.

Macroeconomics:

China decided to roll out the largest stimulus package since the early Covid days in 2020. The People’s Bank of China lowered the (short term) 7-day reverse repo rate from 1.7 to 1.5% – this 20 basis point move is stronger than the expected 10 pt. move. Existing mortgagees rates are expected to decline 0.5%. the PBC also lowered the amount of cash that commercial banks must hold in reserve to relieve pressure on banks. They also plan to reduce the down payment ratio on second-purchases from 25% to 15%. The People’s Bank of China also reaffirmed plans to encourage local governments to buy unsold homes and turn them into subsidized housing, and monetary policy that helps fund-management firms, insurance companies, and private companies to tap into liquidity when purchasing stocks.

Ag Fundamentals:

Reward the rallies. China’s demand could improve with the announces stimulus, but consumption is not expected to excel rapidly. Brazil may not have rain now, but they will by the end of October. Yield estimates may have been pulled back in Indiana and Ohio, but within the next couple weeks Illinois and Iowa will show their hands and they are both holding straight flushes. Port strikes are in the headlines now, but they will most likely be resolved soon after they begin. The hurricane in the gulf could disrupt logistics for a few days, but it may also dump some rain in our river system.

Weather:

Hurricane Helene is at the front of US exporter’s minds today followed by the anticipation of Brazilian rains showing up next month. The drought monitor and soil moisture maps in the US are concerning for next year’s water reserves. If we have a mild winter, we will need a ton of rain this coming spring to catch the country back up to sufficient levels.

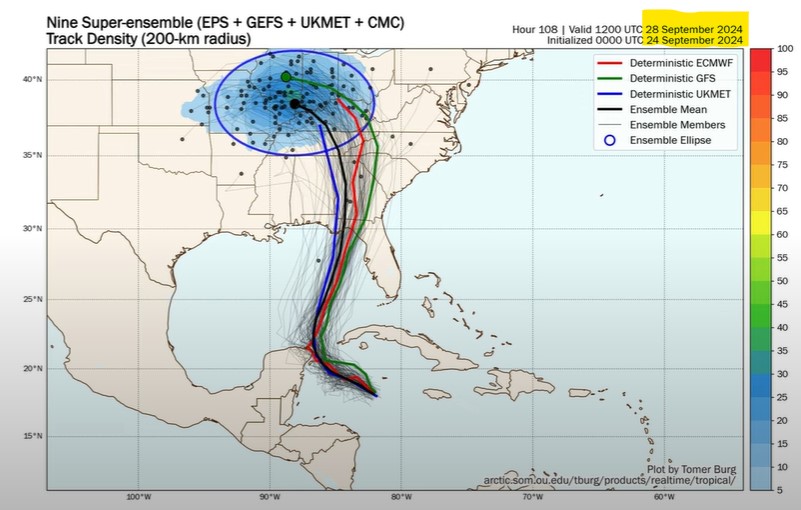

Hurricane Helene’s Track Forecast

The storm is expected to intensify to a Category 2 or 3 Hurricane, meaning winds of 96-130 mph and a surge of water up to 6-12 ft depending on where you are on the coast of Florida. If the storm curls around the Ohio River Valley, it may bring enough moisture to the river to provide relief to low water.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -19 | – 3/4 | -30 1/4 | 63% |

SX24/SF25 | -18 1/4 | – 3/4 | -26 1/2 | 69% |

SX24/SN25 | -53 1/2 | – 1/4 | -105 | 51% |

MWZ24/MWH25 | -21 1/2 | 0 | -30 | 72% |

WZ24/WH25 | -19 1/4 | – 1/2 | -23 1/2 | 82% |

KWZ24/KWH25 | -14 1/4 | – 3/4 | -23 1/2 | 61% |

Cost of Carry

China’s stimulus could increase demand over the next several months, but the effects of the package may not create immediate demand. Brazil’s weather still remains a very important part of the spread complex.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.