MORNING LIVESTOCK FUTURES OUTLOOK

LIVE CATTLE

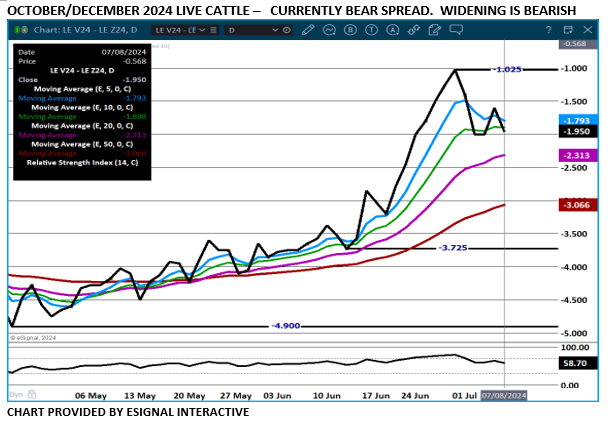

Live cattle traders continue to bear spread. Trade volume was active. It is likely funds re-entered trading Monday with the new allocations for first full trading week of the 3rd quarter and funds that allocate the 2nd half of the year. July is a non-spot futures month and funds use it to their advantage, especially when hedgers retain positions.

LEAN HOGS

Spread traders are moving lean hogs. Funds are big spread traders. Past years have shown spreads from august through December they become increasingly active. When index and equity funds roll , they are selling august and buying October, the algorithmic funds often take advantage and buy October and sell December. There are 4 months from now until October expires giving funds a lot of time.

>>Read full report here

Interested in more futures markets? Explore our Market Dashboards here

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.