by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to display a weak tone, with prices settling $1.66 lower in crude while gasoline and ULSD fell 9.23 and 4.14 cents respectively. The weakness was traced to fear the Federal Reserve will pursue a tighter monetary policy for longer than had previously been expected. Additional weakness was tied to reports that oil exports from Russia’s western ports had hit a four year high in April, despite announced cuts totaling 500 tb/d. Economic concerns for the US and Europe helped offset the strong Chinese GDP of 4.5 percent reported yesterday for the first quarter of 2023.

The draw in crude inventories of 4.6 mb developed despite sales from the SPR of 1.6 mb. Possibly offsetting the decline in crude inventories was the build in gasoline stocks of 1.3 mb while distillate fell .3. Total stocks of crude and products fell .4 mb while the SPR fell to the lowest levels since 1983 at 368 mb. It remains debatable how important this level is given the rise in US production and the move from being a net importer of crude to a net exporter, with this week’s levels showing net exports for crude and products of 2.5 mb. Disappearance levels for products were reported at 19.3 mb against 19.1 last week and 19.0 last year. Gasoline disappearance at 8.5 mb was off from last year’s level of 8.9 but on a cumulative basis is unchanged.

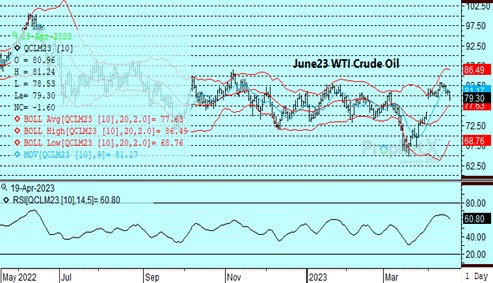

Today’s breakdown has taken values back below the 100-day average at 79.42 basis June. We suspect that the continued disruption of exports from Kurdistan to the Turkish port of Ceyhan along with OPEC+ cuts will limit downside follow-through to the 77-78 range. A pick-up in gasoline and jet kero demand into the summer should tighten supply availability. Key to the outlook will be the slowing of economic activity in OECD economies along with the degree to which Russian availability tightens.

Natural Gas

The market took a step back from its recent push higher, losing 12.2 cents on the day to settle at 2.395 basis the active June contract. Weather forecasts warmed slightly, but for the most part fundamentals were not significantly changed. Production remains steady near 100 bcf/d, with a small downtick in LNG flows possibly raising concerns regarding seasonal maintenance. The reversal on the charts is a near term negative development as trade seems to have turned unimpressed with the colder temperatures expected into early May. Tomorrow’s storage report is estimated to show a 69 bcf injection verses the 5-year average build of 41. The 9-day moving average near 2.345 held support today, and move below there would make the lows at 2.14 basis June the next target. A push above the highs from the last two days would target the 2.60 area, which would achieve a 38 percent retracement of the break since early March.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.