by market analysts Stephen Platt and Mike McElroy

Price Overview

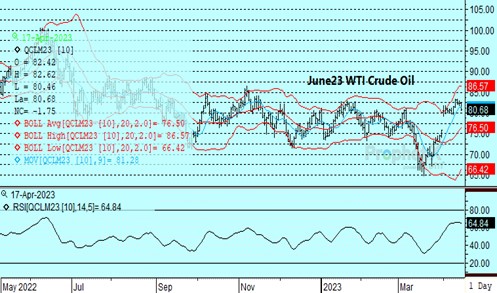

The petroleum complex traded on the defensive with crude oil falling by $1.60 despite the continued disruption of exports from Kurdistan to the Turkish port of Ceyhan following an arbitration ruling three weeks ago that ordered Turkey to pay $1.5 billion for unauthorized exports by the Kurdistan Regional government from 2014-2018. Turkey continues to halt shipments as it seeks to negotiate the payment. Weakness was linked to the rise in interest rates today and strength to the dollar, along with caution ahead of the Chinese 1st quarter GNP forecast tomorrow, which is expected to show an increase of 2.2 percent over the 4th quarter. In the background was maintenance by the G-7 of the $60 per barrel price cap on seaborne Russian oil, which has helped limit their revenues while maintaining energy market stability.

Near term availability is still ample, with weak US exports of gasoline to Europe amid robust supplies, while poor margins in Asia have also limited refinery throughput. The weaker economic outlook should keep demand reserved given the adequate inventories and recent SPR sales in the US. With supplies from Russia still ample, some near term poilrice pressure might be apparent as the market assesses demand prospects. Longer term we look for upside potential toward 91.00 basis prompt crude as stocks tighten in the 2nd half of 2023, with good near-term support in the 77.00-78.00 range.

The DOE report on Wednesday is expected to show crude inventories falling 2.5 mb, distillate off by 1.8 and gasoline lower by 1.9 mb. Refinery utilization is estimated to have gained .6 to 89.9 percent.

Natural Gas

Prices managed to push above the 20-day moving average, settling 16 cents higher at 2.275 on the May contract. Two of the big three fundamental factors assisted in the breakout. Weather forecasts for the second half of the month trended cooler, pushing total demand expectations above normal into early May, and LNG demand hit a record level of 14.8 bcf/d over the weekend. Production was neutral, hovered in the 100 bcf/d area as spring maintenance has yet to surface in a substantial manner. The push higher now targets the 2.44 area, which would mark a 38 percent retracement of the break since early March. With maintenance at LNG facilities also likely to pick up in the coming weeks, the market will have difficulty extending much beyond the 2.50 level near term. 2 dollars remains key support, with a settlement below there opening up the chance for a test down toward 1.80.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.