by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to trade on the defensive, falling decisively through levels which we felt would be support near the 74.00 level yesterday and following through today. The weakness has been surprising given the news but appears to reflect an easing of tightness in cash markets as inventories have been rebuilt in many areas following better availability of Russian crude, increased supplies from the Middle East to European refiners, tepid Chinese demand due to the impact of Covid restrictions and a weaker economic position.

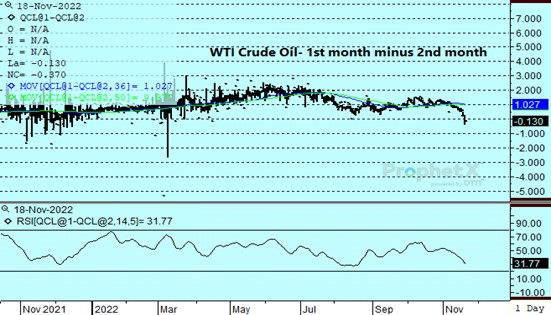

The move to some extent has been foreshadowed by the weakness to the crude backwardation which actually went into contango for the December 22-January 23 spread today reaching down to a 35-cent discount. This was the lowest level of the spread for the first two months on crude since 2021. Despite the impending restrictions by the European Community on Russian shipments of crude and cessation of SPR sales, the spread movement would suggest that supplies of crude are ample into the winter. Whether this holds true remains to be seen and the spread will need to be watched closely for signs that it has turned back to a backwardation, which should provide support to the market on an outright basis as well. The movement in the calendar spreads will likely be a critical factor in OPEC’s output decisions at their meeting on December 4th.

Natural Gas

Good follow-through from Wednesday’s late rally was seen yesterday, as the December contract tested the 6.50 resistance level intraday before weakening into the close. Today’s action saw mixed trade on light volume, with a settlement 6.6 cents lower at 6.303. Weather runs spurred initial weakness, but prices recovered after Freeport finally released an official statement that said work was 90 percent complete and setting a target date for initial production in mid-December. The earlier than rumored date triggered some scattered buying, but garnered less volatility than the string of unverified stories over the last few weeks as trade seemed non-plussed by the somewhat generic language. Yesterday’s storage report showed a 64 bcf injection, slightly above estimates, bringing total stocks in line with the 5-year average. It is likely the last build of the season, as next week’s number is expected to swing to a larger than normal withdrawl on the arrival of below normal temperatures. Today’s settlement above th 9-day moving average makes a near term continuation likely, with 6.50 offering solid resistance followed by 6.69. Weakness will run into initial support near 6.10.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.