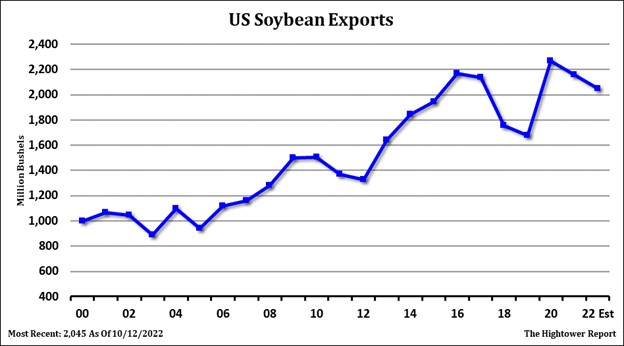

SOYBEANS

Soybeans turned higher today on little new news. Some liquidation of short soybean long grain spreads may be helping soybean futures today. Open interest continues to decline. For some that could be an indication of market may be looking for a lower price move. US soybean basis is also the tail of two markets. Interior basis are firm to crushers with record margins. River basis levels are down due to low water levels. US exports are behind last year. Key is SA weather and China demand.

CORN

Corn futures ended higher. Open interest continues to rise. For some that could be an indication of market may be looking for a higher prices move. US corn basis is the tail of two markets. Interior basis are firm to feeders and crushers as they need corn. Some say current domestic corn stocks are 1 bil bu below last year. River basis levels are down due to low water levels. US exports are well behind last year. Still some estimate that Ukraine could still export 3 mmt of grain each month to Europe by rail. Some could see less farmer selling as harvest nears end. Some feel US final exports could drop below USDA estimate. This could be somewhat offset by higher feed and residual. Ethanol US outlook mixed. US summer travel may be over. Gas prices have come down but inflation is cutting into consumer disposable income. Trade looking for higher US 2023 aces, Higher trend yield and higher US/World 2023/24 end stocks.

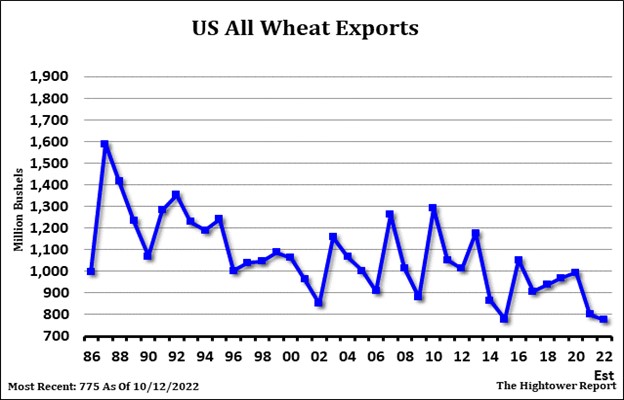

WHEAT

Wheat futures ended lower. Open interest continues to rise. For some that could be an indication of market may be looking for a higher prices move. US wheat export prices are too much of a premium especially versus Russia. Some note that Chicago wheat call option open interest remains high. Possibly a hedge against Russia closing Ukraine export corridor. Still some estimate that Ukraine could still export 3 mmt of grain each month to Europe by rail. Matif wheat was lower. EU wheat continues to struggle with big discounts to Russian wheat. The Black Sea is still a political and logistical mess which does not allow any kind of reasoned market or risk analysis.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.