SOYBEANS

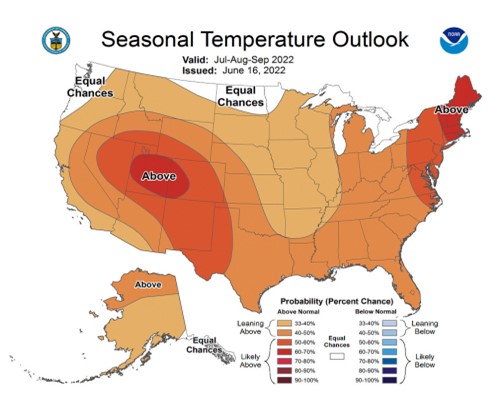

Soybeans ended higher. Weekly US soybean old crop export sales were near 11.7 mil bu. Total commit is near 2,214 mil bu vs 2,263 ly. USDA goal is 2,170 vs 2,261 ly. Anybody notice that total commit are above USDA goal? New crop sales were 15.0 mil bu with total sales a record 481 mil bu. Brazil farmers are cleaning out old crop soybean storage to make room for corn. World soyoil and vegoil prices continue to trade lower on concern about Asian demand and increase Indonesia palmoil exports. Fact NOAA forecasted US 30 and 90 day US Midwest warm and dry especially west cornbelt and fact Bosses of managed fund traders have stopped the traders from selling grain futures is helping prices today. SN traded back over 20DMA near 17.10. Nearby supported by tight US old crop supplies. SN range 16.50-17.50.

CORN

Corn futures ended higher. CN dropped from a high at the end of April near 8.24 to June 1 low near 7.20. CN tested 7.92 today. Fact NOAA forecasted US 30 and 90 day US Midwest warm and dry especially west cornbelt and fact Bosses of managed fund traders have stopped the traders from selling grain futures is helping prices today. Weekly US corn old crop export sales were only 5.5 mil bu. Total commit is near 2,348 mil bu vs 2,728 ly. USDA goal is 2,450 vs 2,753 ly. Where is the beef, I mean sales? New crop sales were 5.5 mil bu with total sales 232 mil bu. Brazil will increase biofuel from B10 to B15. Argentina from B5 to B7.5 with an option to B12.5. End users have to pay $8.00 for Midwest corn and plains cattle producers $9.00. Tight old crop supplies continues to support basis and spreads. On June 30 USDA will release an update to US 2022 acres. Some feel that US corn acres could be closer to 91.0 mil vs USDA March 89.4 and 93.3 ly. They will also estimate Jun 1 stocks. Some estimate stocks near 4,325 mil bu vs 4,111 ly. March to April export demand is est at 870 mil bu vs 1,042 ly, fsi 1,712 vs 1,674 and feed 950 vs 876. Recent stocks report has seen a floating 300 mil bu above or below trade average.

WHEAT

Wheat futures ended higher Weekly US wheat export sales were 8.7 mil bu. Total commit is near 176 mil bu vs 213 ly. USDA goal is 775 vs 805 ly. US SRW prices are competitive to World buyers. US bakers are uncovered for rest of 2022. US warm and dry weather should help HRW harvest. Ample storage could reduce wheat into the demand pipeline. Canada and US ND weather is improving. This week Informa estimated US 2022 spring wheat acres at 10.5 vs USDA March 11.2 and 11.4 last year. Market remains concern about 2022/23 Black Sea and EU export pace. In the Black Sea, satellite photos confirmed that the Nika-Tera storage and terminal complex south of Nikolaev had been rendered ‘unusable’. The complex handled over 7.6 mmt in 2021 and is one of just 2 deep sea Ukraine ports (the other being Odesa) still under Ukraine control. The European and US maps look threatening. Some feel the chances of a harvest price break look increasingly remote. It remains a tough ask for importers to add forward cover at these levels. Supply challenge versus demand, and growing concern about US, Canada, EU and Black Sea supplies and exports could suggest downside may now be limited

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.