by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continues to trade in a choppy fashion with economic prospects posing a bearish backdrop to values despite a gradual lifting of lockdowns in China and the appearance of some stabilization to US financial markets. Support continues to emanate from the low US and global inventory levels. How quickly these begin to stabilize as we move into the higher demand summer driving season remains a key consideration for the complex:

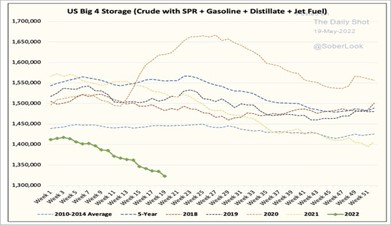

As the accompanying chart shows, stocks of crude, distillate, gasoline and jet kero remain at extremely low levels given increases in demand. The tightness has been reflected in record high prices at the pump which has the potential to slow demand at some point both domestically and for exports. Elevated prices for diesel have encouraged the Biden Administration to consider withdrawals from the rarely used Northeast Home Heating Oil Reserve. Given its size at only 1 million barrels, the impact will likely be minor, but it does highlight how critical the situation is.

The DOE will be watched closely for trends in inventories, disappearance and net export levels. The report is expected to show crude down .7 mb, distillate up .9 and gasoline lower by .4 mb. Refinery utilization is expected to increase .8 to 91.8 percent.

Although fears persist over global supply availability and low inventories, it appears that uncertainty over China’s economy along with demand destruction, particularly in Europe, might ease these concerns for now and limit movement above 115 in July crude, with support likely on sharp pullbacks to the 102-104 level. Movement on nuclear negotiations with Iran should be watched closely along with any progress in diplomatic overtures recently by the US to the UAE and Saudi Arabia.

Natural Gas

Overnight action saw prices trading lower as forecasts revised demand lower on decreased CDD expectations. Buying interest emerged early this morning and prices rallied, surpassing last Wednesday’s high at 8.64. The end of the session saw the July contract settle at 8.827 for a gain of 65 cents. Strenght was offered by the export market, as LNG flows topped 13 bcf for the fifth straight day. This demand looks likely to remain solid, and it continues to underpin the market as talk of a hot summer raises concern about how stock levels can be replenished to comfortable levels by fall. Production has shown some improvement recently, creeping close to 96 bcf this weekend, but the well above normal temperatures seen in May have kept deficits high and further spooked trade regarding the summer trend. With the 8 dollar level tested again early this morning and soundly rejected, the market appears poised to test the early May highs above 9 dollars. Initial support on a retrenchment should surface ner 8.50.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.