by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex showed sharp losses as COVID-19 fears, tighter Fed policy and strength to the dollar encouraged long liquidation, with crude off 4.50 and gasoline down 6.50 while ULSD continued to attract support on prevailing tightness as it recovered late in the session to close higher by 2.8 cents per gallon. The appearance that the EC would not embargo Russian oil imports any time soon also appeared to weigh on values.

Concern that China is moving to enact further COVID-19 lock-down restrictions has been an outlier that we did not fully appreciate in terms of impact. The appearance that Chinese vaccines are losing their effectiveness quicker than expected, along with the lack of availability of alternatives, is helping ratchet down expectations for economic growth. The effect on global growth might also need to be considered given the potential impact on supply chains. Whether the problems have been priced in for now and oil consumption will decline in May will be key in determining the potential impact on inventories given the fall off expected in Russian barrels during that period. Tightening Russian supplies and shortfalls by OPEC+ relative to production targets might be offset for now given the slowing in global growth, the increase in prices and Reserve releases. How China navigates this setback will be a key consideration for price prospects and inventory levels.

The DOE report this Wednesday will be watched for the level of expansion in US production, disappearance, and export levels for both crude and products. Estimates point to crude stocks increasing by 2.2 mb, distillate off 6 and gasoline lower by .5 mb. Refinery utilization is expected lower by .2 to 90.8 percent.

We will be watching support levels in the 92-93 area basis June WTI, which should hold despite the more balanced inventory situation as tightening Russian availability continues to test the market. The outlook for demand is uncertain and for now not enough to limit inventory declines.

Natural Gas

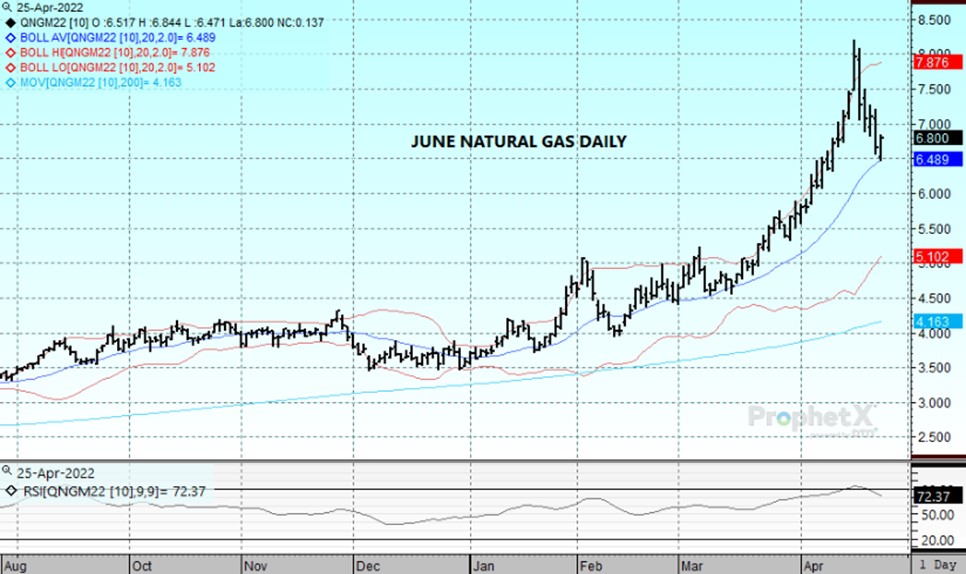

Prices were initially under pressure coming out of the weekend with another new low for the move reached overnight before buying interest developed into the day session. The June contract traded as low as 6.471 before settling 14 cents higher on the day at 6.85. Early weakness was attributed to spillover from the petroleum complex, as demand concerns due to COVID lockdowns in China continued to pressure values across multiple commodity sectors. Continued flows from Russia to Europe also aided the downside bias. Buying interest picked up as the day wore on as a drop in production in the Williston Basin due to severe weather kept concerns heightened regarding the slow pace of output growth. The 20 day moving average near 6.50 offers initial support and beyond that the 50 percent retracement of the March/April rally near 6.38. Resistance appears at the psychological 7 dollar level and then at the 9 day moving average near 7.14.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.