by Stephen Platt and Mike McElroy

Price Overview

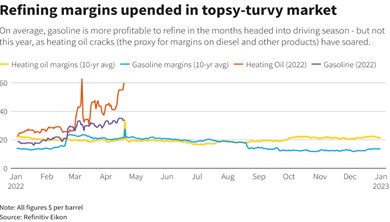

The petroleum complex traded under pressure with crude off 1.75 while RBOB lost 3.40 cents and ULSD was up .90 basis June. Recent selling interest in crude remains linked to demand concerns surrounding COVID lock-downs in Shanghai and a slowing in global growth prospects, along with Strategic Reserve releases. In the background were general economic concerns from strength to the dollar and the rapid rise in interest rates as the Fed tightens monetary policy. Diesel prices continue to find support on setbacks with margins historically strong on an outright basis and relative to gasoline. The strength appears related to strong exports to Europe due to their heavy reliance on diesel as a fuel for cars, tightness in refinery capacity due to shutdowns during the COVID-19 epidemic, and high natural gas prices for which heavier oil is used as an alternative in some areas.

We are unconvinced that lower valuations are justified. The prospects for demand are uncertain and for now not enough to limit inventory declines. Instead, the under-compliance of OPEC+ which produced 1.45 mb/d below its target in March and ongoing blockades against major oil fields and pipelines in Libya where as much as 550 tb/d of oil has been shut in will likely remain as sources of concern for supply availability. In addition, further sharp declines in Russian availability are likely in May as sanction continue to bite. Only a dramatic shift in OPEC policy toward higher output from the Saudis and UAE or a quick breakthrough in Iranian nuclear negotiations could upset the deficit forecast in the months ahead.

Natural Gas

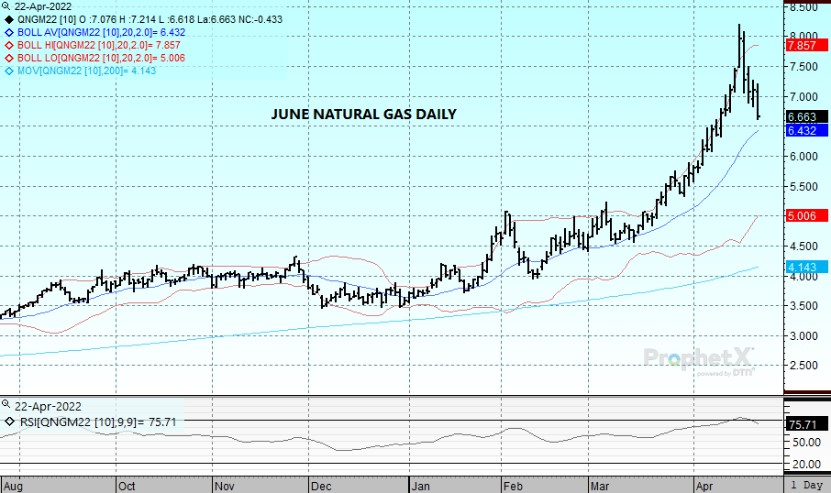

The market continued to probe lower in search of support as the active June contract ended the session at 6.663 for a loss of 43 cents. The downward bias was amplified yesterday following the weekly storage report that showed a larger than expected 53 bcf injection into stocks. The build was above average and decreased the deficit to the 5 year average albeit slightly. Prices quickly recovered as underlying supportive factors that fueled the recent rally remain intact, but the strength could not be maintained today. Production continues to struggle, as output has hovered in the 94 bcf range all week, but LNG flows are also below capacity as seasonal maintenance continues. An overall risk-off tone to commodity markets added to the weak bias. With the 6.71 area taken out the next support level should emerge near the 50 percent retracement of the March/April rally near 6.38. Initial resistance comes in near the 7 dollar level.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.