by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continues to trade in a firm fashion as the focus remains on supply tightness rather than signs that demand is slowing, particularly in China. Reports that Libya’s National Oil Company had declared a force majeure on some output and exports as opposition forces in the East expanded their blockade of the oil sector over a political standoff offered support. The company had indicated it could no longer honor contractual obligations for deliveries from Zuetiana oil terminal, or from Shaharra and El Feel, which halted production over the weekend. Protest groups appear to have entered and closed the facilities to protest the current prime minister who has remained in power following the collapse of a scheduled election in December as the Eastern based parliament moves to appoint a new government to replace the current administration, which was appointed by a UN process last year. The opposition controls extensive areas of Eastern Libya where key production facilities are located.

The withdrawal of this supply has compounded problems and is exacerbating tightness ahead of further declines in Russian availability expected in May. This has drawn attention away from signs that Chinese demand remains weak and continued SPR releases. Questions over how quickly the flows from strategic reserves will occur due to pipeline capacity restraints in the US along with issues over the type of crude does pose uncertainty and is helping to attract short covering amid the low level of inventories ahead of the summer season which brings higher gasoline demand.

The DOE report will be watched closely for inventory, production, and usage trends. Current estimates point to a build in crude stocks of 2.5 mb, with distillate and gasoline off by .9 and 1 mb respectively, while refinery runs are expected to have risen .9 to 90.9 percent.

The market appears to have priced in SPR releases along with the demand impact of Chinese Covid lockdowns. We still feel values have potential to reach up toward the 115.00 level basis June crude, with sympathetic buying being provided by the strength to natural gas which reached over 8.00 per MMBtu today.

Natural Gas

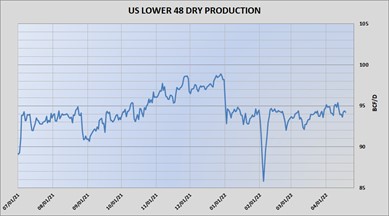

Prices gapped higher coming out of the weekend and never looked back as the May contract gained 52 cents to settle at 7.82. The early strenght was ignited by cooler forecast revisions into the end of the month that upped demand expectations, while the underlying story line of a lower than expected production pace, solid exports, and potential sanctions on Russian gas kept the bulls in charge. Last weeks storage injection of 15 bcf was below the average build of 33 for this time of year, and left total stock nearly 18 percent below the 5 year average. With each passing day showing no trending improvement in output, rebuilding inventories to a comfortable level by fall becomes more difficult. The strenght of the rally today may indicate that the stubborn fund net short position is finally getting flushed out, with the psychological 8 dollar level being violated late in the session. The charts are void of any obvious targets until you look to the early 2000’s on a monthly basis, where the 9 dollar level offered some resistance prior to moves well above 13. RSI is now over 90 percent, with any retrenchment likely searching out this mornings gap down at 7.346, with support below there at the 38 percent retracement level near 6.71.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.