SOYBEANS

Soybean ended higher. Corn and wheat traded higher. Soy complex followed. When does a market that sees fundamental glass half empty turn to half full?. Trade volume has dropped due to increase market volatility. Ukraine War added to rally in Crude which may have helped commodities. SK range on Friday was 16.51 to 16.89 ending near 16.68. Today’s range was 16.66 to 17.10 and ended near 16.91. One of the biggest bulls in the market has turned bearish. Their weather guy now sees normal US Midwest and plains Weather. This and lack of new US soybean sales for last 4 days suggest 17.10 SK could be a key high. Weekly US soybean exports were near 20 mil bu. Season to date exports are 1,569 vs 1,977 ly. USDA goal is 2,090 vs 2,261 last year. Informa will be out tomorrow with their estimate of US 2022 Soybean acres. They have been using 87.8 vs 87.2 last year.

CORN

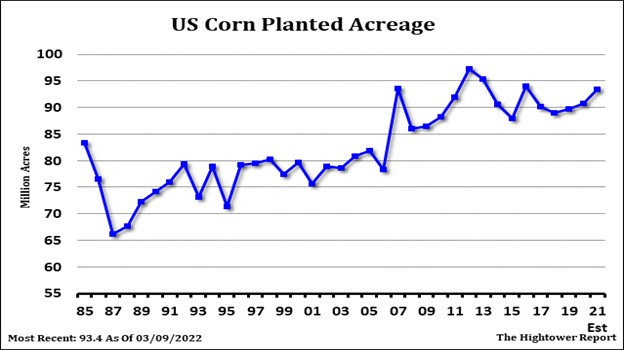

Corn futures ended higher. Wheat traded higher. Corn may have followed. When does a market that sees fundamental glass half empty turn to half full? Trade volume has dropped due to increase market volatility. Ukraine War added to rally in Crude which may have helped commodities. CK range on Friday was 7.36 to 7.55 ending near 7.41. Today’s range was 7.43 to 7.65 and ended near 7.56. Weekly US exports were near 57 mil bu. Season to date exports are near 1,078 mil bu vs 1,268 last year. USDA goal is 2,500 vs 2,753 last year. Informa will be out tomorrow with their estimate of US 2022 corn acres. They have been using 91.5 vs 93.3 last year. USDA estimates US 2021/22 corn, soybean, wheat and sorghum exports near 5,700 mil bu vs last year’s record of 6,290. 2021 Sep-Dec exports were near 2,284 vs last year’s record of 2,746. Some could see final US 2021/22 exports closer to 6,110. Some feel US 2022/23 exports could be a record 6,485.

WHEAT

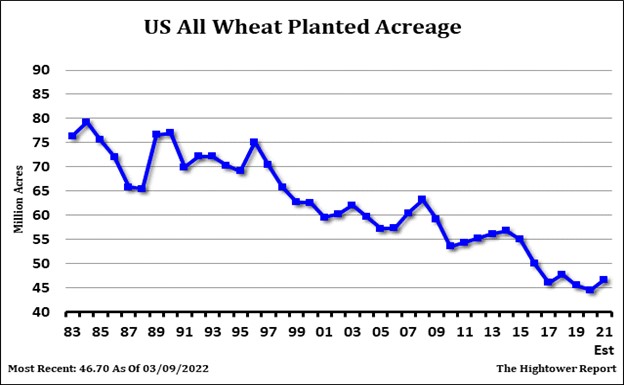

Wheat futures ended higher but off session highs. Combination of the continued Ukraine war and disappointing weekend US south plains rains helped rally wheat futures. On Friday, WK range was 10.55 to 11.06. WK ended near 10.63. Today, WK range was 10.61 to 11.48 and ended near 11.19. On Friday, KWK range was 10.55 to 10.97. KWK ended near 10.70. Today, WK range was 10.70 to 11.48 and ended near 11.13. Weekly US wheat exports were 12 mil bu. Season to date exports are 608 vs 736 ly. USDA goal is 800 mil bu vs 992 ly. There remains concern how World wheat importers will replace 30 pct of World wheat trade. Informa will be out tomorrow with their estimate of US 2022 wheat acres. They have been using 48.1 vs 46.7 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.