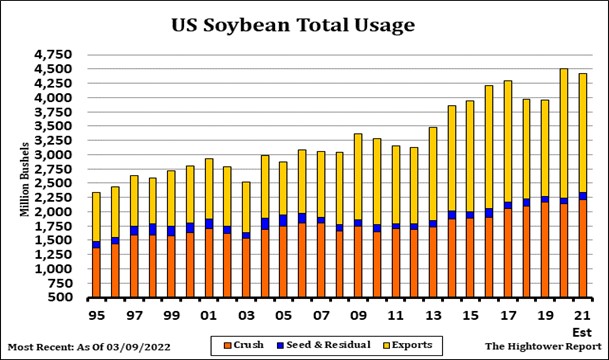

SOYBEANS

Soybean futures ended lower. Soybean had rallied after China said they would support their economy. This raised hope that China might buy US soybeans. Dalian soybean and soyoil futures traded higher while soymeal traded lower. Spread of Covid in China has caused citywide lockdowns and raised concern about commodity imports. Some now fear that China could take less than 92 mmt of soybean imports. Brazil soybean fob values are above US and 125 cents above last year. Trade estimates US weekly soybean export sales near 900-1,800 mt versus 2,204 last week. SK is back near the 20 day moving average and remains in a broad 16.00-17.00 trading range. Increase volatility has dropped trade volume which could trigger wider price changes.

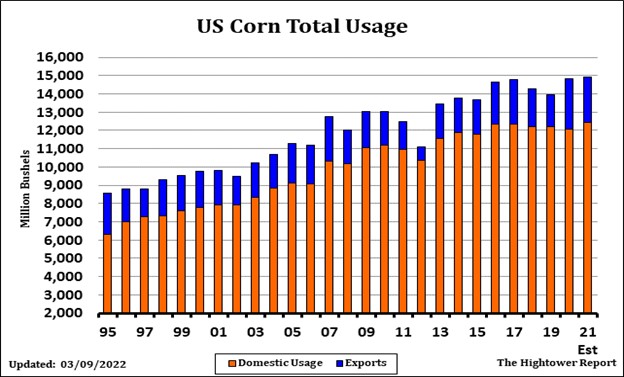

CORN

Corn futures ended sharply lower. Rumors that a Ukraine War ceasefire may happen soon offered strong overhead resistance. A ceasefire could open up Black Sea grain exports. Some though feel it could be weeks before grain could be shipped from Ukraine. Recent highs in CK were made of fear that Ukraine may not be able to ship 500 mil bu of corn of which 235 mil bu was to China. Trade estimates US weekly export sales near 700-1,400 mil bu versus 2,143 last week. Weekly US ethanol production was near last weeks pace but up 5 pct versus last year. Stocks were up 2 pct from last week and up 21 pct from last year.

WHEAT

Wheat futures ended down the daily prices limit. US Weather forecasters look for .75-1.50 inches of rain early next week across parts of the US south plains. Actual amounts and coverage will be key to prices. Volatility in wheat is extreme which is reducing trade volume and increase chances of wild price swings. If War continues, where will buyers find 10 mmt Black Sea wheat? Weekly US wheat export sales are est near 250-600 mt. India may export 10 mmt wheat vs USDA estimate of 8.5. WK ended near 10.69. Session high was 11.59. KWK ended near 10.72. Session high was 11.60. MWK ended near 10.50. Session high was 11.10.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.