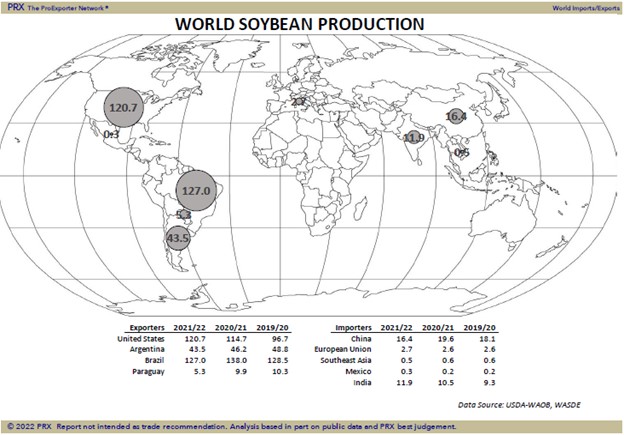

SOYBEANS

Soybean and soymeal futures ended lower. There was talk that Managed Money took profits after SK failed to close over 17.00 and SMK over 490. So far this month, nearby soybean range has been 16.48-17.45. Feb range was 14.85-17.65. Talk China was selling SBO and RSO from reserves and lower than expected Malaysia February palmoil exports offered resistance to soyoil. Soyoil rallied with bounce in Crude. World Oct-Feb soybean and soymeal exports were near 67.6 mmt vs 62.4 ly. US soybean 39.4 vs 46.3 ly. Brazil soybean 17.1 vs 6.4 ly. Brazil soymeal 7.4 mmt vs 5.7 ly. USDA Oct-Sep goal is now 172.0 mmt vs 175.4 last year. South America crop could be down another 180 mil bu after USDA dropped crops 350 mil bu in March. SX was supported this week on talk South America could run out of soybean for exports as soon as September.

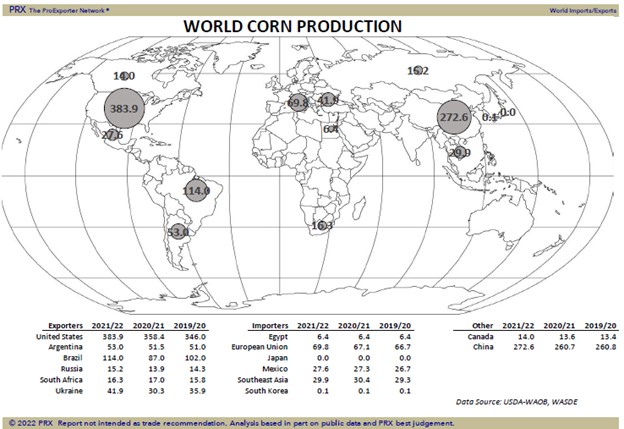

CORN

Corn futures ended higher. Continued concern about lower Ukraine corn exports and lower South America corn supplies offered support. There was some follow through buying from Thursday higher than expected weekly US corn export sales. They were the highest of the year. Brazil corn crop could be down 200 mil bu and Argentina 235 mil bu from USDA latest guess. Ukraine might not exports 500 mil bu of corn. There were also concerns that Ukraine may not get their 2022 spring crop planted. Today, UN estimated that Ukraine may not harvest 20 pct of the winter crops and spring crop acres could be down 30 pct. There is talk that Spain may be looking for 50-100 mil bu US corn. There is also talk that Brussels could allow for GMO corn imports due to low corn supplies. This could add to US corn export demand. Some could see US 2021/22 corn exports closer to 2,800 mil bu vs USDA 2,500. Same group sees US 2022 acres near 91.5, yield 180.0, crop 15,155, demand 15,235 and carryout 805. CN should gain on CZ due to record US summer corn export program.

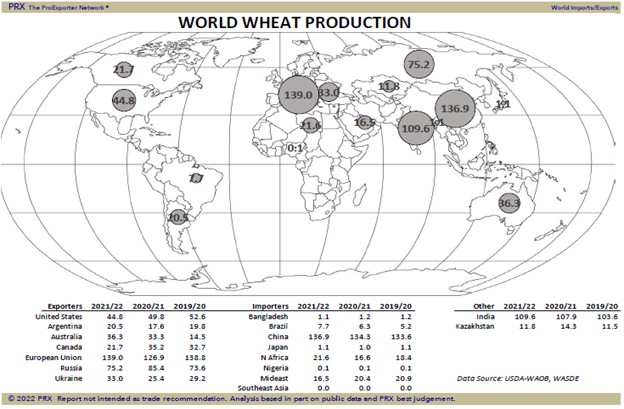

WHEAT

Wheat futures ended higher. WK ended near 11.06 with a range 10.43-11.26. KWK ended near 10.89 with a range of 10.35-11.05. MWK ended near 10.70 with a range of 10.30-11.02. Those ranges could be good for some years. Overnight wheat trade was higher on concern that continued Ukraine War would slow their wheat harvest and continue to limit wheat exports from the Black Sea. Some feel combined Black Sea and EU exports could be down 915 mil bu from USDA estimate. NOAA also reported that La Nina could continue through US spring which increase chances for a dry US HRW spring. Some estimate US 2022 wheat acres near 48.0, yield 49.1, crop of 1,915, demand 2,071 with exports at 925. This would suggest a carryout 525. US HRW carryout could be below 200.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.