by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued its upward climb with values reaching 113.85 overnight, below yesterday’s highs in April WTI of 116.57. Economic sanctions on Russia, while not explicitly targeting their daily exports, which total near 5 mb/d, have severely hampered their ability to sell crude. In the background were consumer worries over the impact the sharp rise in petroleum prices will have on inflation and economic activity. The US, because of its energy independence and dollar strength, has been somewhat immune from the global fallout, but other areas such as Europe have considerably more exposure due to their dependence on Russia for oil and gas.

The sharp rally above the highs seen prior to the shale revolution in the 2010-2014 period and before that when values reached as high as 147.27 in July of 2008 is affecting those that have stepped up to condemn the invasion, while others such as China, India and OPEC members seem intent on protecting their own interests. How this plays out in the world economy remains to be seen, but the impact of bringing some of the world community together in a show of resolve with Western governments against the invasion provides hope moving forward, although significant challenges remain.

The market’s volatility is not for the faint of heart and only those looking to mitigate risk should attempt to be involved. High prices ultimately tend to be the cure for high prices, but for now the unseen threats on the supply side, including more profound sanctions on oil exports from Russia, are too high in our judgment. The potential for prices to advance toward the 120 area exists given the fear that sanctions on Russian oil exports might still be enacted to ramp up diplomatic pressure even further.

Natural Gas

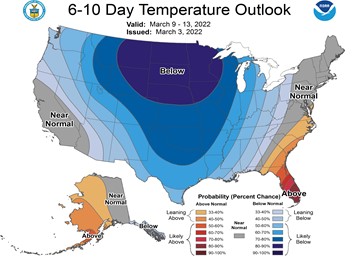

The market continued to work higher albiet at a much more measured pace than the crude and products. April traded through the 5 dollar level and ended the session with a gain of over 29 cents cents at 5.016. European prices reached all time highs today and continue to be the main underlying driver of US values. Fundamentals at home have turned supportive as well with temperatures in the 6-10 day window looking to be below average across the US, with the Rockies and Texas seeing some potential for production freeze-offs. Wind generation has also seen a substantial dip this week that has lead to as much as 4.7 bcf/d in added gas burn. Yesterday’s reported 139 bcf draw from storage was in line with estimates but well above average for this time of year, with total stocks now more than 13 percent below the 5 year average. The war in Ukraine will remain a focus of the market for the forseeable future, and with the 5 dollar level breached upside follow through looks likely, with 5.50 the next target. Initial support on a retrenchment now moves up to the 4.90-93 range.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.