by Stephen Platt and Mike McElroy

Price Overview

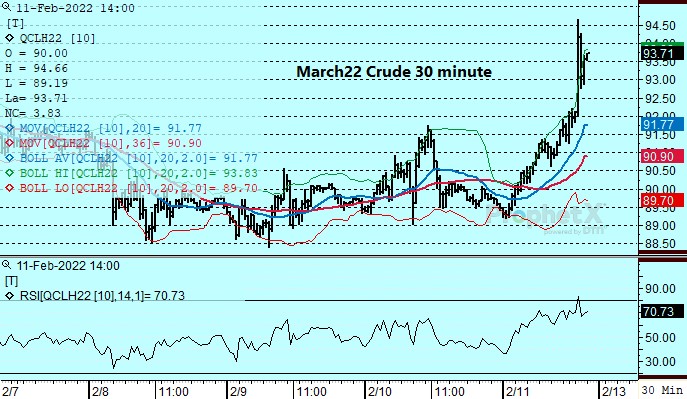

Prices surged to the upside today as the March crude gained over 3 dollars and the products were higher by 7 to 8 cents. The strength was attributed to positive indications in the Monthly IEA report, continued signs of inflation in the US and some delayed reaction to the DOE report. Buying interest surged late in the session as fears of a Russian invasion grew more intense. Reuters reported that they were amassing more troops at the border near Ukraine and that an invasion could come at any time according to Washington sources.

The IEA expects world oil demand to increase by 3.2 mb/d in 2022 to 100.6 mb/d as COVID restrictions are eased. Inventory tightness continues to be a concern as OECD stocks were off by 60 mb in December, with a further drop likely for January, and OPEC’s underperformance continued as their January output was 900 tb/d below the targeted level. As expected, SPR releases have proven ineffective, as world stocks have declined by 355 mb over the last year while SPR releases totaled 50 mb. Despite the current negative setup, the group still expects a swing to surplus in 2022, with non-OPEC producers potentially adding 2 mb/d.

The Russian news blew prices through the 93.00 level basis March to a high of 94.66 before settling at 93.10. Given the severity of the move, it might represent a blow off top if nothing of major significance develops in the Ukraine this weekend.

An invasion would undoubtedly change the key dynamics for the oil market in many ways. How bullish it would be is debatable given the uncertain policy and economic impacts both globally and domestically. In the background are some bearish indicators, with US oil rig counts increasing at their fastest pace in over 4 years, rising 19 to 635 this week. This is the highest level since April 2020. Forecasts suggest that independent E & P capital investment will increase up to 25 percent this year after only increasing 4 percent in 2021. This suggests higher prices are having an impact on US and global investments. In addition, the IEA expects the market to shift to surplus in 2022. The Agency stated that the UAE and Saudi Arabia have capacity to keep the market well supplied and might be willing to given their strong alliances with the West. In addition, an Iranian agreement cannot be ruled out as Western powers continue to soften their stance to a lifting of sanctions.

Natural Gas

Prices struggled to find any support into the end of the week as the March contract lost 2 cents to settle at 3.941. With production back near 95 bcf/d and the warmer expectations for the second half of February continuing to confirm on weather models, there isn’t much for the bulls to get excited about at the moment. With mild temperatures in Europe and a lack of news on the Russia/Ukraine front, the underlying support seen the past few months from overseas has waned as well. Yesterday’s storage report showed a draw in line with estimates at 222 bcf, pulling total stocks 9 percent below the 5 year average. The market was unimpressed with the large draw as the warm temperatures expected for late February have alleviated much of the fear of EOS tightness. A near term cold spell this weekend was the only thing offering underlying support, but with the 4.00 level taken out the path of least resistance appears to be downward with no substantial support evident until the mid-January lows in the 3.63 area. A recovery would be depended on a reversal of the recent forecast trend, with initial resistance near 4.25 and then up at Monday’s gap above 4.487.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.