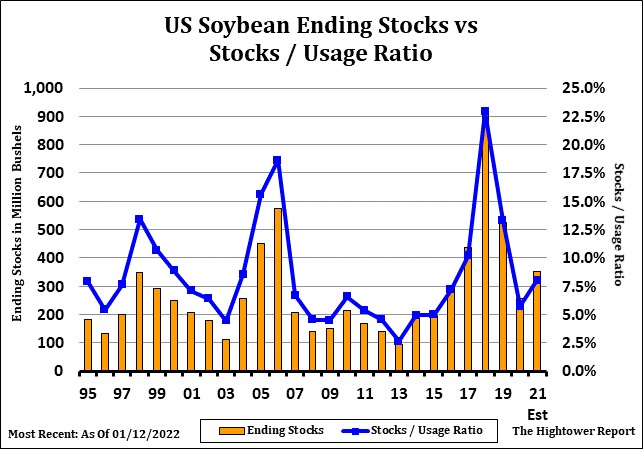

SOYBEANS

Soybeans ended slightly lower. SH tried to trade over 15.64 after good old and new crop soybean sales. Soymeal gained on soyoil also on good US sales and lower palmoil prices weighed on soyoil. Trade is expecting record Dec soybean crush and higher soyoil stocks. There was also concern that record high palmoil prices could slow demand for palmoil. Weekly US soybean sales were 1,095 mt. Total commit is 45.2 mmt vs 58.5 ly. China commit is near 25.4 mmt. New crop soybean sales increased 881 mt. Weekly US soymeal sales were 605 mt. Total commit is near 7.5 mmt vs 7.2 ly. Talk of a Paraguay soybean crop of only 4.4 mmt vs 10.0 normal could reduce exports to Argentina and a lower Argentina soybean crush. Trade estimates Brazil soybean crop at 133.6 mmt vs USDA 139 and Argentina at 44.5 vs USDA 46.5. 7 mmt drop is well below some est of 24 mmt. Trade est US 2021/22 soybean carryout near 310 mil bu vs USDA 350 in January.

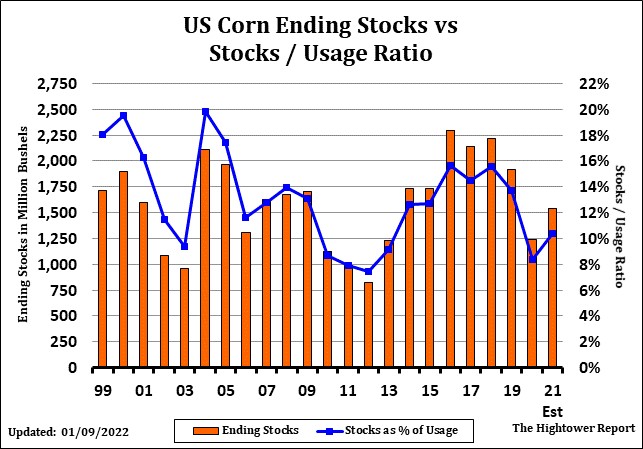

CORN

Corn futures ended lower. Managed funds turned sellers after Wednesday higher than expected weekly US ethanol stocks and drop in margins. Most feel supplies will drop once spring and summer driving increase. Corn selling increased after US China Ag attaché dropped their estimate of China 2021/22 corn imports to 20 mmt vs USDA 26. More selling was triggered by USDA announcing China had cancelled 380 mt US corn. Some feel this could be a mistake and could be new soybean sales. Weekly US corn sales were 1,175 mt. Total commit is 45.1 mmt vs 58.5 ly. China commit is near 12.4 mmt. If US Ag attaché is right, US exports are 12 mmt. Ukraine has shipped 7-12 mmt. This suggest China imports are 19-24 mmt or they could be done buying US. Trade estimates Brazil corn crop at 113.6 vs USDA 115 and Argentina at 52.1 vs USDA 54.0. This is only 4 mmt drop. Some could see Brazil closer to 106 and Argentina closer to 40. That would be a 23 mmt drop. The large drop could increase demand for US corn exports. I t could also drop, US 2021/22 corn carryout dangerously low and could prompt a rally in corn prices to encourage US farmers to add acres. Trade estimates US 2021/22 corn carryout at 1,512 mil bu vs USDA January estimate if 1,540.some in the trade are as low as 1,200.

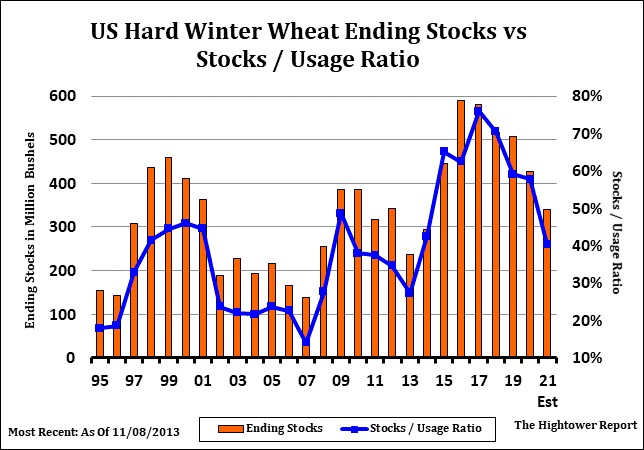

WHEAT

Wheat futures ended mixed. WH was down 3 cents and near 7.51. KWH was up 1 cent and near 7.70. MWH was down 7 cents and near 9.00. Funds continue to add to WH short due to slower US export pace and a hedge against long corn and soybean positions. KWH has had a wild ride. KWH rallied from the Jan 14 low of 7.43 to the Jan 25 high of 8.49 to only the drop to todays low at 7.53. Supply bulls feel that a drop in EU and Russia wheat exports from USDA estimate and an eventual increase in tension between Russia and Ukraine and Russia and NATO could still rally prices. Talk of a drier than normal US south plains for the rest of February and March could stress the US 2022 HRW crop. Trade estimates US 2021/22 wheat carryout at 629 mil bu vs USDA Jan 628. Trade also estimates World 2021/22 wheat end stocks at 279.9 mmt vs USDA Jan estimate of 279.9. Weekly wheat export sales were only 57 mt. Total commit is 17.2 mmt vs 22.4 ly.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.