Price Overview

The petroleum complex moved up sharply in early trade before fading late in the day. Values reached a new high for the move with March trading to 88.84 before settling near unchanged. The early buying was traced to forecasts that Chinese crude imports will rebound by up to 7 percent this year, reversing the decline in 2021. The recovery is not expected until the second half of the year, with crude imports expected to rise by 600-700 tb/d compared to a decline of 550 tb/d in 2021. Reports that Russia had softened their tone with respect to Ukraine brought out selling, with Foreign Minister Lavrov making more conciliatory comments with talks still planned over the next few weeks. The market also turned cautious in advance of the OPEC+ meeting on February 2nd. The group is reportedly planning to stick to its output increase of 400 tb/d in March. However, over-compliance with the output cuts and inability of some producers to meet their targets, along with the possibility of other producers filling in for current shortfalls might come under discussion given the high prices and market tightness.

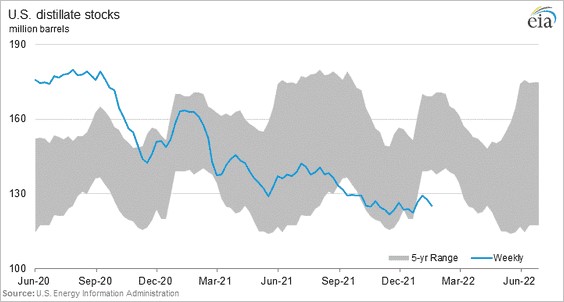

A major force that needs to be reckoned with is the strength to the margins of distillate to crude. The crack margins have moved sharply higher in response to steady declines in stock levels of distillate as demand strengthened on cold conditions and good freight traffic. They reached as high as 28.50 before pulling back toward 27.00 today. Fears of high prices impeding demand could begin to temper the strength, although limited refining capacity should continue to restrain refinery throughput and provide support on pullbacks.

The likelihood that the Federal Reserve will continue to tighten monetary policy in reaction to inflationary pressures should help moderate movement in crude to the upside. Dollar strength has also injected uncertainty over demand trends outside the US. Any effort by OPEC to expand production faster than currently envisioned also has potential to undercut values given the overbought posture in the market.

Natura Gas

The last two days have seen extreme volatility in natural gas as the expiring February contract saw a short squeeze yesterday that pushed prices over 3 dollars higher late in the session before they went off the board with a gain of nearly 2 dollars at 6.265. The active March has gained 60 cents since Wednesday’s close, ending the week at 4.639. The move got underway soon after the storage report yesterday, which showed a large 219 bcf drawdown that swung total stocks back under the 5 year average. Below normal temperatures into the middle of February have been maintained in the last few forecast revisions, and talk of 200 plus stock draws extending out to the week ending February 11th, which would be a record 5 straight weeks, flushed out worries over end-of-season stock levels. The strength was supported by a backdrop of geopolitical tension that saw President Biden and the EU discussing ways to ensure gas supplies in the event of a Russian invasion of Ukraine. The tensions solidify belief that US exports will remain near capacity for the forseeable future and added underlying support to the move. A substantial storm moving into the East Coast this weekend that could bring as much as two feet of snow to Boston and surrounding areas has also heightened concern as production has been slow to recover from recent freeze-offs, with the potential for more in the near future. Profit taking late in the session left prices well off their highs, but the breakout and settlement through the 100 day moving average has left the next resistance level at the November highs just above 5 dollars. Any significant loss of HDD’s over the weekend could lead to a quick retracement to the 4.25 area.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.