Price Overview

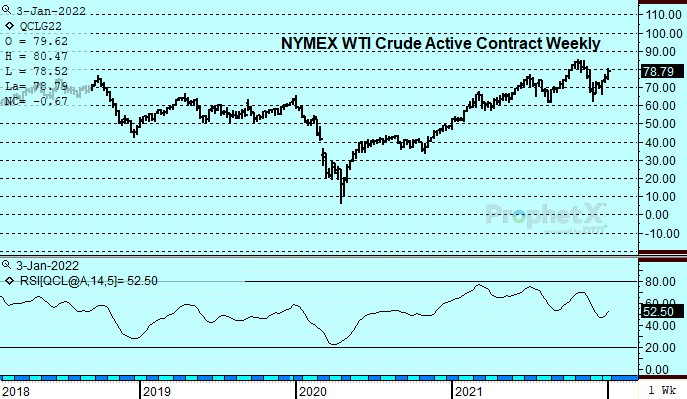

The petroleum complex pulled back from recent strength as the market assesses the impact of unrest in Kazakhstan and shortfalls in OPEC’s production against planned targets in December amid slowing payroll growth in the US, increases in interest rates, and a tighter Fed policy.

The market appears to be primed for a retracement of the recent upside trend. The situation in Kazakhstan has stabilized due to the government’s hard-line approach to protesters and following the involvement of Russia sending paratroopers at the request of the government to quell the uprising. It may well be that the events in Kazakhstan soften the Russian stance toward Ukraine given a possible reluctance to further inflame tensions around their borders. The production survey by Reuters continues to show that OPEC is experiencing challenges hitting increased output targets. The survey showed OPEC 10, which is party to the production agreement and not exempt, cut 3.033 mb/d in December compared to the 2.383 pledged. This put the actual production compliance at 127 percent, an increase from November’s level of 120 percent.

Forecasts still suggest surpluses in the first quarter albeit smaller than had been expected. Although Omicron concerns have eased, it still appears the worst might be ahead in terms of infection rates, which could reign in mobility and demand for gasoline and jet kero in the next few weeks and lead to further stock builds that could weigh on values. OPEC Middle East producers have maintained targeted production levels and appear to have capacity for further expansion. Whether they will attempt to make up for shortfalls by African producers remains to be seen, along with whether Strategic Petroleum Reserve releases take place as planned. A wild card remains the Iranian Nuclear negotiations where reports on progress have been lacking.

Natural Gas

The market managed to return to the upside after a disappointing storage number yesterday, as the February contract settled over 10 cents higher at 3.916. The 31 bcf draw was well below expectations near 54, and prices reacted negatively following the release but were well supported in the 3.80 area. The arrival of colder temperatures continues to offer support with the 15-day forecasts running nearly 24 HDD’s above normal. The cold weather has affected production, with output off by over 3 bcf/d from late December levels due to freeze-offs. Early expectations for next week’s report are in the 175-180 range compared to normal at 144. With storage currently 3 percent above the 5-year average, the market likely needs a string of above average draws as we work through January to violate the 4.00 level. A settlement through there would point to a test of the 4.25 area, which would be a 38 percent retracement of the break from late November. 3.80 remains solid support with overseas premiums remaining high and LNG flows improving.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.