Price Overview

The petroleum complex traded on both sides of unchanged as the market assesses supply demand prospects ahead of the OPEC+ ministerial meeting taking place tomorrow. Underlying support continues to be provided by ideas the impact from the Omicron variant will be mild and temporary and that demand will continue recovering in line with growth to the global economy. The prospect was most recently indicated by OPEC’s Joint Technical Committee in which they indicated revisions upward in demand for both 2021 and 2022 and showed stocks remaining below the 2015-2019 average in the first three quarters but rising above the average in the 4th quarter. Demand growth was left unchanged at 5.7 mb/d in 2021 and 4.2 mb/d in 2022. Additional support to values continued to be apparent from ideas that African producers and likewise OPEC will face challenges in reaching output targets in coming months as supply chain issues limit investment in new wells and maintenance keeping production restrained while shortages of Nat Gas in Europe should encourage additional demand for petroleum derivatives.

Geopolitical tensions from the Russia/Ukraine situation and Nord Stream 2 delays continue to offer underlying support. The uncertainty compounds current issues with shortages of key inputs and has created questions regarding supply and capital investment as we move into 2022, helping underpin a shift upward in inflationary expectations. The appearance that OPEC+ is maintaining the output increase in February at 400 tb/d should offer resistance as prompt Brent reaches toward the 80.00 level and fears over prospective cuts in demand and further hikes in output from non-OPEC countries emerge. In addition, the prospect that stock levels will slowly rise will also remain in the background as a restraint on the upside to prices. Key to the outlook remains China and the level of monetary stimulus they provide their economy in the new year.

The DOE report on Wednesday is expected to show another draw in crude of 3.4 mb, distillate and gasoline are expected to show stock builds of 2.7 and 3.0 mb respectively. Refinery utilization is expected to increase to 90.2 percent from 89.7 in the prior week.

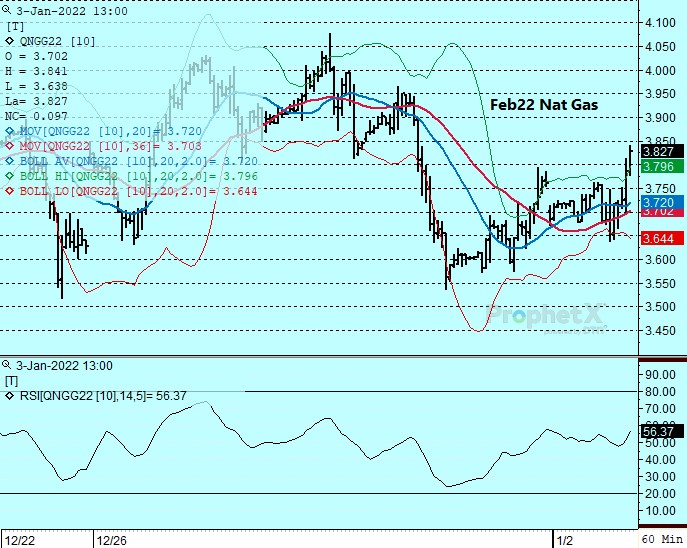

Natural Gas

Prices attracted good support following early selling reflecting prospects for below normal temps into mid-January for the Eastern US supporting usage. With stocks still above normal in the US but well below normal in Europe and Asia expansion in US export capacity is likely to take place over time providing support to the back months. A further draw down in US storage is likely in this weeks EIA report with forecasts for a draw of 158 bcf compared to a five year average draw of 108 bcf and 127 bcf a year ago. The large draw should help underpin values particularly if colder temperatures take hold and provide support near the 3.70 level and resistance at 4.00 basis February.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.