Price Overview

The petroleum complex failed to follow through on early strength and settled lower. The buying was linked to news that although OPEC+ would stick to their existing policy of monthly oil output increases of 400 tb/d, they would review supply additions ahead of their next meeting in early January to see how the Omicron variant has affected demand and adjust earlier if necessary. In the background and keeping the market cautious was the startup of negotiations with Iran, which some believe does not have the air of urgency that it had earlier given the steep sell-off in oil over the past week. In addition, the US and other countries were moving ahead with reserve releases, with China reportedly indicating that they were considering it as well. Forecasts for stocks to build in the first quarter also provided a cautious backdrop to values.

OPEC+ forecasts that an expansion in supply will develop in 2022, overtaking demand by up to 4 mb/d in March, assuming a reserve release of 70 mb. For the most part the forecast has been discounted by the spreads, which have fallen sharply since November 1st when they reached a high of 6.77 in the January/June to 1.23. A recovery in currently low stock levels in crude and products would help provide a cushion to push prices back above the 75.00 level basis January. The trend in the spread could foreshadow whether the support at 65.00-66.00 holds up until more information is gleaned on the demand side and the size of the stock build. In addition, the control that OPEC members have on the supply side and their intent to balance the market will also be a prime consideration in price direction.

Natural Gas

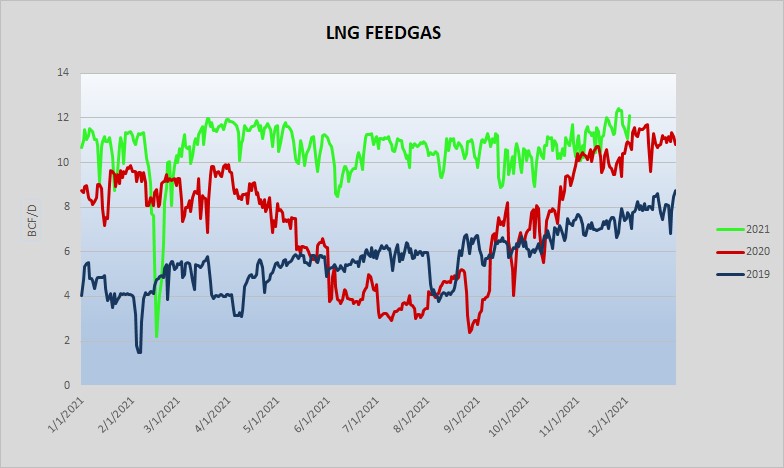

The natural gas market continued to probe lower yesterday, with the January trading down to an intraday low at 4.042 before finding some support today to end the session with a gain of 7 ½ cents, settling at 4.132. Fundamentals saw some minor improvements, although short covering ahead of the weekend following 4 days of heavy losses likely accounted for much of the volume. A return of LNG flows to the 12 bcf/d level after a mid-week pullback offered support. The first revision higher in HDD expectations in nearly a week also prompted some buying interest. Yesterday’s storage report showed a 59 bcf draw from stocks, slightly above estimates, but was only able to garner temporary support. The inside day on the charts and close in the lower half of the day’s range might signal that the market is not done probing the downside, with weather the key determinant of near-term direction. The 4.00 level remains solid support, but a return to the mild weather trend could see 3.50 as a potential downside on typical overextension. If the cooling trend in the back half of the 15-day forecasts can be maintained, the market could bounce considerably from current oversold levels. 4.50 would emerge as psychological resistance, with 4.60 and then 4.77 representing a 38 and 50 percent retracement of the break since last Friday.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.