Price Overview

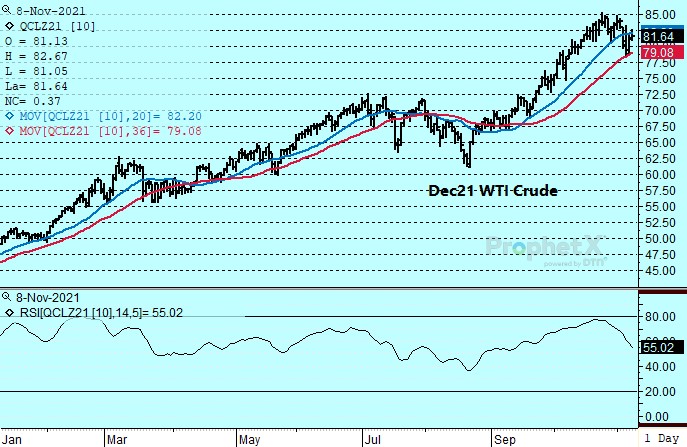

The petroleum complex attracted good underlying support in response to a larger than expected crude price hike by Saudi Arabia for shipments to Asia in December. The increase in the differential to Dubai and Oman prices was more than double the November level, hiking the Official Selling Price by $1.40 per barrel to 2.70, the highest since September. The price hikes come on the heels of a planned increase in output of 400 tb/d by OPEC+ in December. Expectations were for an increase of 30-90 cents, and the larger change might reflect concerns over developing tightness as we enter the Northern Hemisphere winter. In the background were more positive signs for economic growth following the passage of the US infrastructure bill and China’s export growth, that despite slowing, beat forecasts for October as some improvement in energy shortages and supply chain issues were noted. The better-than-expected export levels in October helped soften concern over the weakening domestic economy in China and led them to a record trade surplus of 84.54 billion.

The strong recovery since Friday’s lows reflects a belief that the OPEC+ agreement to maintain output increases in December along with underlying strength to the global economy, particularly in the US, suggests a relatively tight stock situation that would allow little room for unexpected supply shortfalls or better than anticipated demand strength. US demand has surpassed pre-pandemic levels, and the possibility that shortages outside the US in other main fuels such as natural gas and coal will boost demand for petroleum derivatives as we move into the Northern Hemisphere winter provides a bullish bias to values and limited downside for now. Potential for a release from the US Strategic Reserves to temper prices might do so in the short term but is unlikely to change the long-term dynamics. Key considerations will be how quickly E & P capital investment responds in an environment that is discouraging carbon-based solutions. At this juncture OPEC+ appears to be in control and intent on preserving current valuations and possibly pushing them higher if demand can be maintained.

The DOE report on Wednesday is expected to show crude stocks up 1.9 mb, gasoline down 1.0 and distillates lower by 1.3. Refinery runs are expected to improve .8 to 87.1 percent.

Natural Gas

Prices traversed unchanged levels multiple times today before settling 9 cents lower at 5.427 basis December. Early strength was offered by downward revisions to the 2 week forecasts verses Friday’s outlook. That soon ran its course as the cooling continues to be in the back end, which has been the case thus far in November but has for the most part failed to materialize. With the 1-7 day period still offering above normal temperatures and production continuing to impress over the weekend, the market had little trouble finding sellers at the higher levels. Support on selloffs continues to be offered by improving LNG flows, which have held above 11 bcf for 3 days now, even with Freeport continuing to deal with issues that could potentially restrain flows there for another 10-12 days. With European stocks already starting to be drawn down and Sabine Train 6 looking like it is preparing to come online, US exports are set to continue their solid trend, and flows in excess of 12 bcf/d have been suggested as possible this winter. Initial support comes in near 5.38, which marks a 68 percent retracement of last weeks rally, and below there at the October lows near 5.07. The 5.50 area now marks the first level of resistance, followed by the 5.65-5.70 area.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.