Price Overview

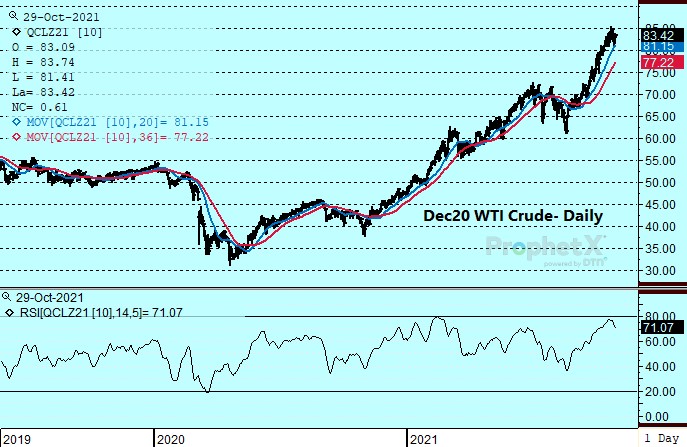

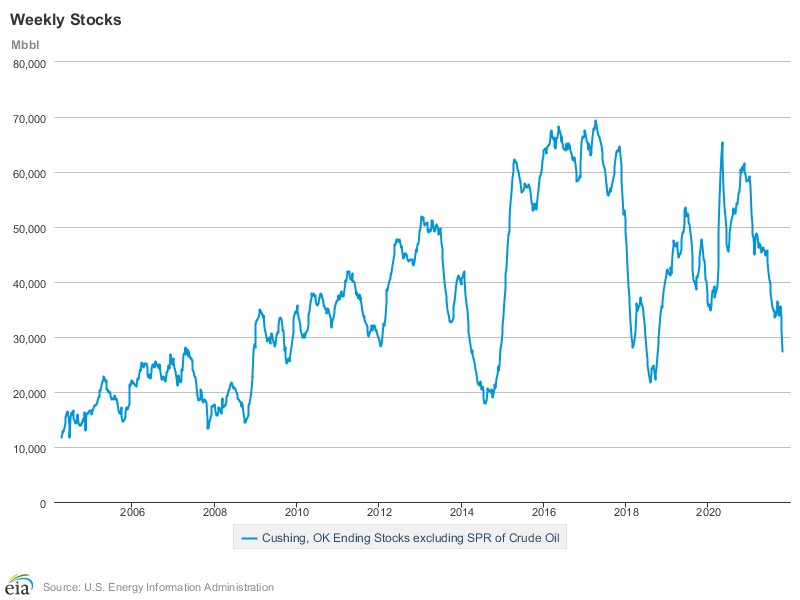

The petroleum complex traded in a volatile two-dollar range before closing modestly higher. Early strength linked to reports that OPEC would likely maintain the current production target increase of 400 tb/d at the Ministerial meeting on November 4th ran into overhead selling spurred by reports that nuclear talks with Iran and the JCPOA would resume in late November. In addition, selling interest was linked to weakness in industrial markets such as copper which appeared to reflect ongoing concerns over economic prospects following the weaker than expected US GDP report, along with concerns over Chinese economic growth due to power shortages and supply chain woes. Dollar strength was in the background as a consideration along with upward pressure on interest rates. Weakness encountered support near yesterday’s lows at 80.58 on concern over the low crude stocks at Cushing and expectations that a pick-up in refinery utilization due to attractive margins and the approach of winter will lead to inventory drawdowns in the first quarter. Improving chances that the budget reconciliation deal will ultimately be passed provided background support on pullbacks in the front months.

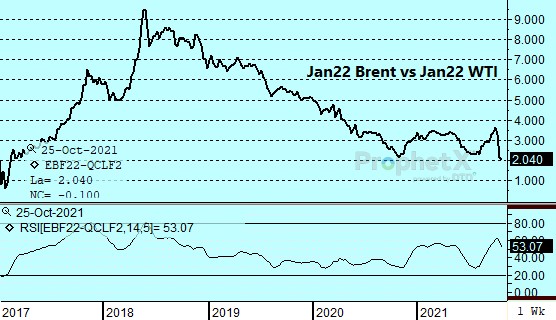

The tightness in Cushing stocks continues to underpin WTI relative to Brent, taking the WTI discount from over $3.80 per barrel at the beginning of October to under 2.00 today basis January. Continued tightening at Cushing has potential to pressure the differential toward even money, a level not seen since 2016. A more appropriate analog year might be 2008 when WTI reached a premium of over 2.50 and stocks at Cushing fell below 20 mb, with WTI reaching over 140 dollars per barrel.

Natural Gas

The wind came out of the sails yesterday as the December contract lost over 40 cents, followed by another 35 cent drop today to end the week at 5.426. Weakness started early in yesterday’s session as European prices continued to fall precipitously following comments earlier in the week from Russian President Putin that they would begin rebuilding European stocks early in November. Selling continued after the storage report, which indicated an 87 bcf injection, which was near estimates but improved total stocks to just 3.4 percent below the 5 year average. Production continues to trend upward, nearing 95 bcf/d to end the week and added to the downside pressure. Underlying support was offered by continuing improvement in LNG flows, with an 11.8 bcf reading yesterday raising confidence that November will see a steadier trend that could exceed 12 bcf/d. The quick pullback has filled the gap from Monday’s higher open, with support now all the way down at the October lows near 5.07. Volatility does not seem likely to let up as we head into winter as European prices have plummeted without a single bcf of additional gas received from Russia and US values become more sensitive to weather forecasts. Initial resistance looks to surface in the 5.65 to 5.70 area, but with these prices traversed multiple times in the last two months, any swing in momentum could see prices rapidly rebound above the 6.00 level.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.