Price Overview

The petroleum complex was on the defensive with values falling sharply in response to US crude inventories rising more than expected along with ongoing concerns over the health of the global economy given recurring spikes in Covid infections, particularly in Asia. Pressure on Chinese coal prices due to government attempts to discourage hoarding at illegal storage sites was in the background as a negative influence as a decline in coal prices tempers forecasts for an increase in petroleum derivatives usage for power generation.

The DOE report showed commercial crude inventories rising 4.3 mb while gasoline fell 2.0 and distillates were off .4. Of interest was the decline in Cushing stocks of 3.9 mb while Gulf Coast inventories rose 9.6 mb. Refinery utilization continued to increase, coming in at 85.1 percent compared to 84.7 last week as margins remain favorable. Total product supplied eased off from the 21.8 mb last week to 19.8 mb as the residual, or other oil, fell by 1.1 mb from last week’s large increase while gasoline and distillate showed declines of .3 and .4 mb respectively.

Follow through on the downside is likely to attract scale down support on indications that OPEC+ will follow through on their strategy to gradually increase production by 400 tb per month as uncertainty over economic prospects persist. Inventory levels still appear to be getting drawn down which should help attract support. A gauge of tightness in deliverable supplies for the US market continues to be the backwardation, which on Monday blew out to over 8.00 on the December 21-June22 crude and stands near 6.80 today despite the large decline in Cushing stocks. The increase in Gulf Coast stocks might suggest better availability and pose additional weakness to the backwardation.

Until a more definitive upward trend in global inventories is seen and OPEC production increases more substantially, we believe that support will be apparent on a further pullback toward the 80.00 level basis December.

Natural Gas

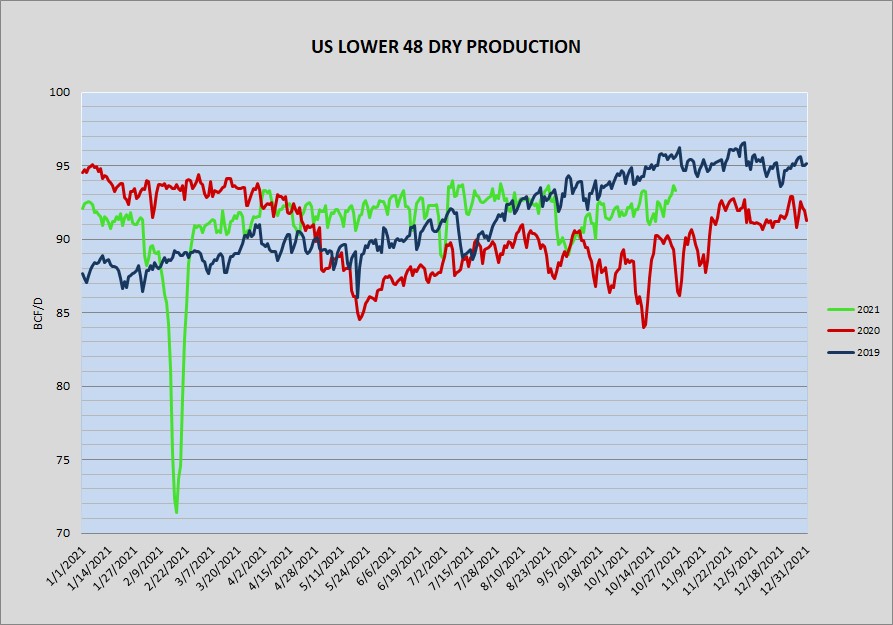

After trading somewhat sideways yesterday, the market found good buying interest today. The December contract ended the session up 19 1/2 cents at 6.198, the highest settlement since the rally to 6.50 early in the month. As we enter the withdrawl season the market has become primarily weather driven, as evidenced by the early weakness yesterday that followed the toning down of Monday’s cooler forecasts, only to be reversed by another colder revision this morning that sparked buying interest and pushed the market to new highs for the week. The recent pullback in overseas prices further empasizes the US markets current preoccupation with weather. Production has finally started to show some improvement, surpassing 93 bcf over the last 3 days, but has thus far offfered little resistance as LNG flows slowly improve and Mexican exports have crept up to 6.7 bcf/d. Expectations for tomorrow’s storage injection are in the 86 bcf area comparet to the 5 year average at 62. With wind generation being one of the variables that gives analysts the most trouble estimating, the high wind output last week has upped the potential for a low side miss. The 6.00 level would be the first line of support on any knee jerk reaction to a higher build, with 5.75 the next level if momentum builds. The contract highs near 6.59 still stick out as the next target on a continuation of the recent rally.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.