Price Overview

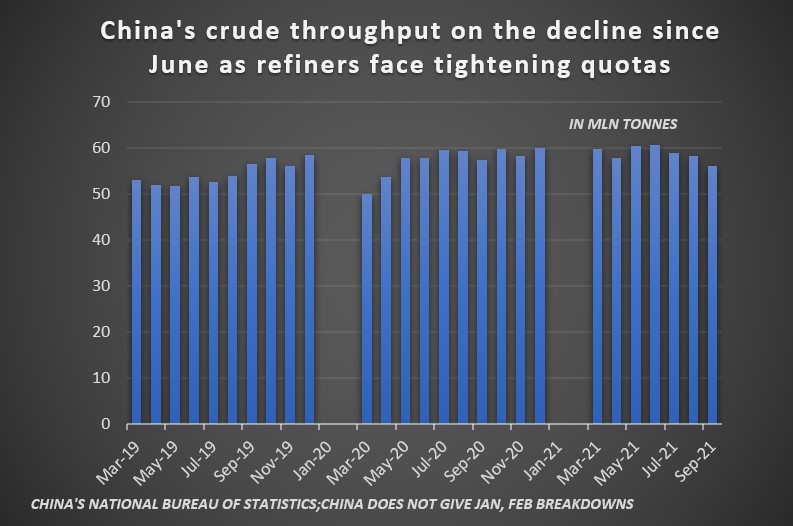

The petroleum complex failed to follow-through on early strength which saw December Crude surge to a high of 83.18 before settling back to register modest losses. Early support appeared to be linked to prevailing fundamentals which continue to suggest that OPEC+ disciplined production approach is continuing to lead to a steady draw-down in stocks. Compliance levels with the output cuts was reported at 115 percent in September. Selling at the higher levels was based on reports that China’s 3rd qtr GDP grew at 4.9 percent below the 5.2 percent forecast and US Industrial production declined 1.3 percent in September. The weaker than expected GDP reading is leading to a reassessment of growth prospects for China with Barclay’s revising down their fourth quarter forecast to 3.5 percent from 4.7 percent previously. For China, this was the slowest pace of growth in a year as reforms in the power, property and technology sector pose challenges. The policy reforms including import quotas on crude oil and more stringent environmental rules on refineries has impacted Chinese refinery throughput which hit a 16 month low in September to the lowest level since May, 2020.

At this juncture, the petroleum complex appears to be overextended given the RSI near 75 and recent increases in US crude inventory levels and rig counts with the most recent numbers showing an increase of 12 to 445, 205 above last years levels for oil rigs. The accelerating rate might inject some uncertainty over crude oil flows in the US which might offset the decline in production rate of some African producers. In addition, the most recent Commitments report also showed a waning of hedge fund interest on the long side which appeared to be profit taking. Subsequently, we still see the uncertain outlook for economic growth and expanding crude demand outside of China to contain breakdowns to the 77.00 level basis November. We continue to look at resistance likely near 83.00 basis Dec on questions regarding the Iranian nuclear negotiations which could be revived and trends in economic growth. A key consideration will be the longer-term forecasts for temperatures this winter in key consuming areas such as Europe, the US and China.

The DOE report is expected to show a build in crude of 2.2 mb, distillate -2 and gasoline -1 while refinery utilization is expected off .2 to 86.5 percent.

Natural Gas

The natural gas market continues to shrug off the EIA report which showed a smaller than expected injection last week. Prospects that consumption will be weaker than normal as temperatures trend above normal and wind generation rises helped weigh on values and led to forecasts for storage injections to be above normal. With LNG export levels returning to normal following the return of Cove Point, we look for the market to begin attracting better support near current levels at 5.30 basis December. The storage report on Thursday is expected to show an injection of 94 BCF. In addition the EIA will be presenting their 2021-2022 Winter Fuels Outlook tomorrow that could impact sentiment as well.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.