Price Overview

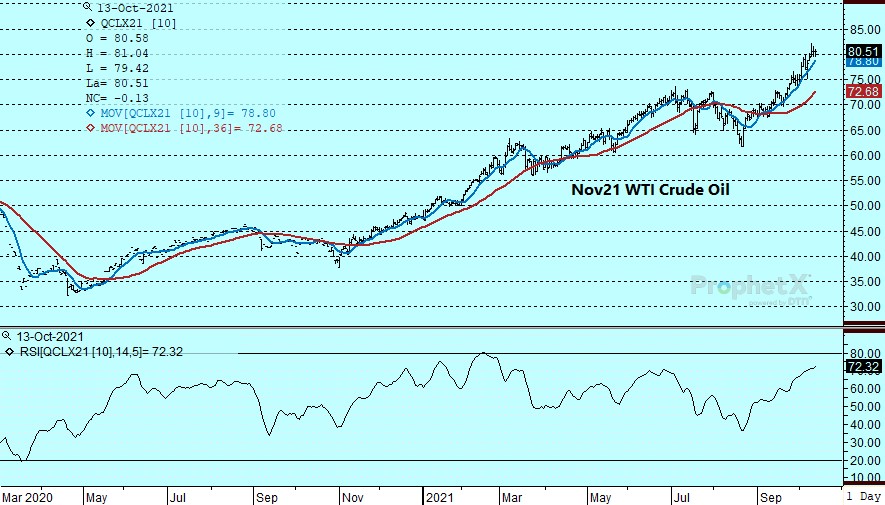

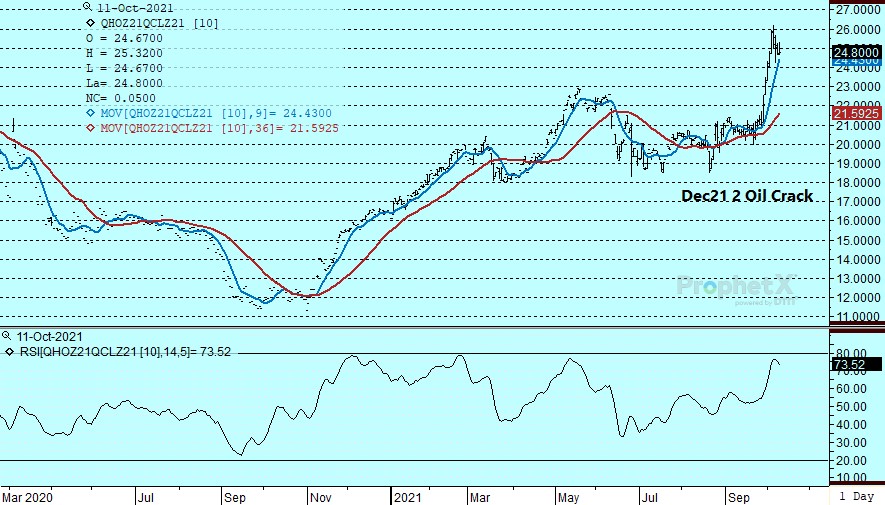

The petroleum complex traded in a mixed fashion as concerns over economic growth emerged as supply chain disruptions and inflationary pressures pose challenges for major economies. Of particular concern are shortages of natural gas and coal in Europe, China and India which appears to be affecting economic output while at the same time encouraging the use of petroleum derivatives as a substitute. In Europe natural gas prices are near $180 per barrel on an equivalent basis to crude oil. How much demand might shift remains a source of uncertainty, with the OPEC Monthly Report suggesting that if this trend continues, products such as fuel oil, diesel and naphtha could see higher demand growth driven by power generation, refining and petrochemicals. Along with the cautious policy by OPEC+ with respect to output levels, a continuation of inventory tightness into the first quarter of 2022 is likely until a clearer outlook on weather for the Northern Hemisphere winter emerges, or some allowances for additional demand are made by OPEC+.

Given the abrupt rally, some caution on the long side needs to be exercised given the large long spec position and the possibility that demand will suffer due to the higher prices and shortages of power in India and China, which could throttle economic growth. In addition, the sharp price spikes in distillate and to a lesser extent gasoline need to be monitored for any sign that underlying disappearance is weakening.

While talk continues of the decreased investment in E&P for crude and natural gas, the higher prices might encourage more capital infusion in 2022. Although this will likely not have an impact on near term production, it could affect back month price expectations in the second half of 2022, particularly if key producers such as Saudi Arabia and Russia attempt to expand output to meet demand during the first quarter when the deficit is expected to be greatest.

The release of supply/demand data by the IEA and the DOE inventory report tomorrow should provide insights into these macro trends. The DOE report is expected to show crude inventories up by .1 mb, distillate down 1.0 and gasoline higher by .1. The uncertain outlook for economic growth and potential for expanding crude demand should contain breakdowns to the 77.00 level while resistance is likely near 83.00 on uncertainty over Iranian nuclear negotiations and trends in economic growth. A key consideration will be the longer-term forecasts for temperatures this winter in key consuming areas such as Europe, the US and China.

While talk continues of the decreased investment in E&P for crude and natural gas, the higher prices might encourage more capital infusion in 2022. Although this likely will not have an impact on near term production, it might affect price expectations on the back months in the second half of 2022, particularly if key producers such as Saudi Arabia and Russia attempt to expand production quicker than currently envisioned to meet expected demand during the first quarter when the deficit is expected to be greatest.

The release of supply/demand data by OPEC on Wednesday followed by the Monthly IEA Report on Thursday should provide insights into macro trends and could create some nervousness in advance of their release, posing resistance at the 83.00 area basis November. Breakdowns below 77.00 are unlikely in the near term as the potential for further inventory tightening ahead of winter provides support.

Natural Gas

Prices traded down to an intraday low at 5.168 basis November early yesterday before staging a recovery that carried over through today’s session as we ended higher by 8 1/2 cents at 5.59. With production setting back to well below 92 bcf/d the last couple of sessions and LNG flows over 11 bcf for the first time in a month, it is not surprising to see the market show some improvement, but ultimately the direction of recent trade has mirrored that of overseas price points as the shortages there remain the focus of energy market headlines. Mild US temperatures have extended the injection season, with tomorrow’s report expected to show a 94 bcf stock build verses the 5 year average of 79. Despite the improving storage situation in the US, the market will remain tied to the fate of Asian and European prices. When colder temperatures develop, either here or overseas, there might not be much to impede a run back to the contract highs. 5.80 and 5.97 look to be possible resistance levels, with the 5.30-5.35 range offering key support on a settlement basis.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.