Price Overview

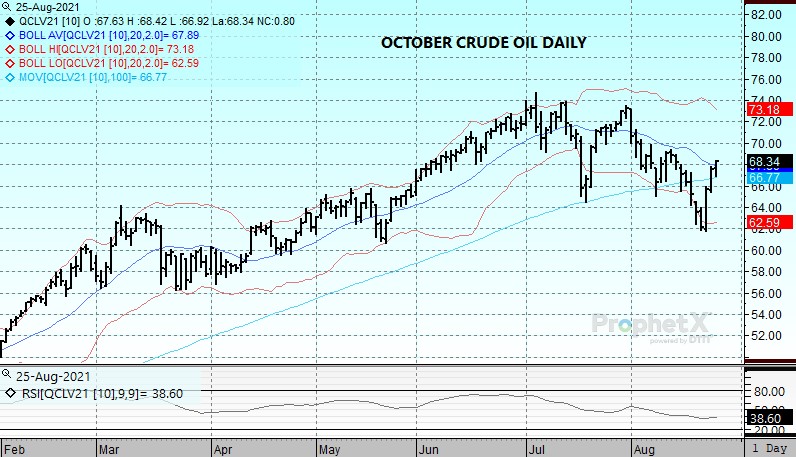

The petroleum complex traded near unchanged levels, settling modestly higher following extreme volatility over the past week. Buying in reaction to the PEMEX oil platform fire in the Gulf of Mexico, which shut in as much as 400 tb/d, appeared to have been limited following reports that lost production would be restored by the end of the month which helped moderate concern that a force majeure would be invoked. Instead, the market appeared to focus on other influences including the tapering of Covid infections in China, the DOE report, and comments from OPEC+ that they believe the market is adequately supplied ahead of their planned meeting on September 1st.

Reports from China indicated 20 new confirmed cases of COVID yesterday compared to 35 a day earlier and no new deaths. The appearance that infection rates are coming under control has helped contain fears of a renewed economic contraction. Nevertheless, concerns continue to surround the accuracy of the data along with the impact of the Delta variant on other areas in Asia.

The DOE report also attracted support as crude inventories continue to fall as they were indicated to be down by 3 mb in the week ending 8/20/21 compared to expectations for a decline of 2.4. Gasoline stocks fell by 2 mb against expectation of a decline of 1.7 while distillate inventories rose .6 mb. Total petroleum stocks including crude were 1,878.7 mb, a decline of 4.8 versus the prior week. It is interesting to note that despite the increase in net imports of crude to 3.34 mb compared to a 4-week average of 3.14, the crude oil stock decline remained above expectations as disappearance remained high at 21.8 mb/d compared to a four-week average of 21.0. For the year, US gasoline disappearance is 9.7 percent above year ago levels while distillate is 10.7 percent higher. With most inventory levels well below their five-year averages, forward coverage has gotten progressively tighter and should provide support against the 65.00 level basis October in advance of the OPEC+ meeting.

Natural Gas

The market managed to press up to an intraday high this morning at 4.021 before pulling back to end the session near unchanged levels at 3.925 basis October. With a tropical depression popping up in the Caribbean Sea overnight, trade had a knee jerk jump higher as the potential track includes Gulf of Mexico production areas. The strength soon faded as the reality of a path through the heart of offshore production would also point to landfall somewhere between Texas and Louisiana and pose risks to LNG facilities and shipping routes. The development of this storm will need to be watched closely and will likely increase volatility as we finish out the week. Weather reports indicated little change overnight but still point to above normal demand into the first week of September. Tomorrow’s storage report is estimated to show a 40 bcf injection verses the 5 year average at 44. Some concern regarding decreased wind generation last week has swayed sentiment toward a low side of expectations for tomorrow’s release, which offered underlying support. The 4.00 area still looks like formidable resistance, while any pullback on a higher-than-expected injection should encounter initial support near 3.85.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.