Price Overview

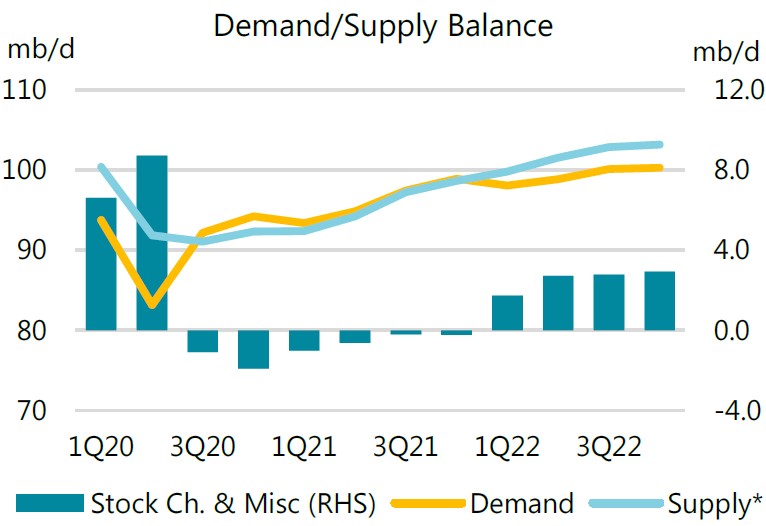

Prices traded lower today as the market attempts to assess the supply/demand outlook as we move into the 4th quarter and then 2022. The challenges were amply apparent in the IEA and OPEC monthly reports released yesterday. Following a stagnation in demand growth in July due to the spread of the Delta variant, the IEA revised their forecasts downward for the remainder of 2021. The about face raised questions over how large the supply deficit will be in the fourth quarter, which had been estimated at over 2 mb/d previously but now looks to be around 1 mb/d.

The forecast by the IEA contrasted with OPEC, who continues to see a rebound in oil demand this year and further growth in 2022 despite the recent rise in Covid infections. Their optimistic outlook for demand contrasts with their view that supplies will increase faster than previously expected as higher prices stimulate investment in US shale areas and other capital projects. Talk that OPEC will need to revise its supply plans if lower demand forecasts prove correct continues to pose enough uncertainty to provide support toward the 65.00 area basis prompt crude. Given this uncertain demand outlook, the Biden administrations entreaties to expand production and cool the impact of high gasoline prices on economic growth might be ignored until a clearer picture is determined by key producers within OPEC+.

Natural Gas

Prices continued to slip into the end of the week as the September contract lost over 7 cents to settle at 3.861 following steep declines yesterday. Selling pressure started to emerge after the weekly storage report indicated a 49 bcf build in stocks, which was in line with estimates but above the 5-year average of 42. A steady pullback in CDD expectations as the week wore on seemed to take some of the pop out of the market as well, and as the hottest stretch of the summer ran its course with a simultaneous jump in wind generation the upside momentum stalled out. With the 4-dollar level breached over the last two sessions, the 3.83 area looks like the next level of support. LNG flows remain the underpinning force in the market, and with European storage levels likely to end the summer well below average, US exports are poised to remain at full tilt well into the winter. With Tropical Depression Fred reminding trade of the approach of the most active part of hurricane season, the September contract has likely seen its highs, with the 4.05 level emerging as resistance to a bounce in prices.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.