Price Overview

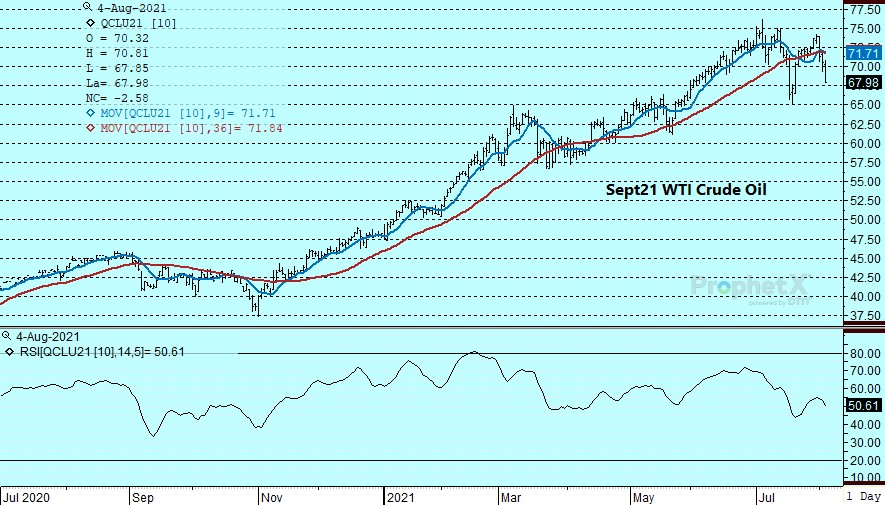

The petroleum complex came under sharp downside price pressure once again as concerns over China’s economic prospects proliferated a midst concerns over the Delta variant forcing renewed lock-downs in that country. The market also responded to the DOE report which showed an unexpected build in crude inventories. The concern over China appeared to take center stage following reports that in Wuhan mass Coronavirus testing was indicated following a series of Covid outbreaks. In Beijing, the top transportation official cut off travel into the capital to protect it from exposure to the virus. Speculation the vaccines manufactured and utilized in China might not be as effective in fighting the Delta variant might have exacerbated the concerns over a tightening of restriction on mobility.

The DOE report was also taken in a negative fashion. The report showed US crude inventories rising by 3.6 mb compared to expectation of a decline of 2.9 mb. Of note has been the draw in Cushing stocks which fell .5 mb to stand at 34.9 mb, the lowest level since October, 2018. Refinery utilization failed to rise as strong as expected and rose only .2 percent to 91.3 percent compared to expectations for an increase of .8 percent. Total inventories including products fell by 1.2 mb as gasoline inventories fell by 5.3 mb. Distillate stocks rose by .8 mb compared to forecasts for a small draw. Total disappearance for all products supplied was stable at 21.2 mb with the increase in gasoline disappearance of .5 to 9.8 mb/d offset by a decline in distillate demand of .7 mb to 3.6 mb.

Given the importance of China as a key consumer and importer of crude and products, the uncertainty over the inroads of the Delta variant and potential impact on demand is being watched closely. The impact on demand will be a key variable on how quickly inventories are drawn down into the end of the year. The breakdown to below the 70.00 level is negative and recovery rallies will be keyed to how quickly the Delta variant is controlled and in what manner.

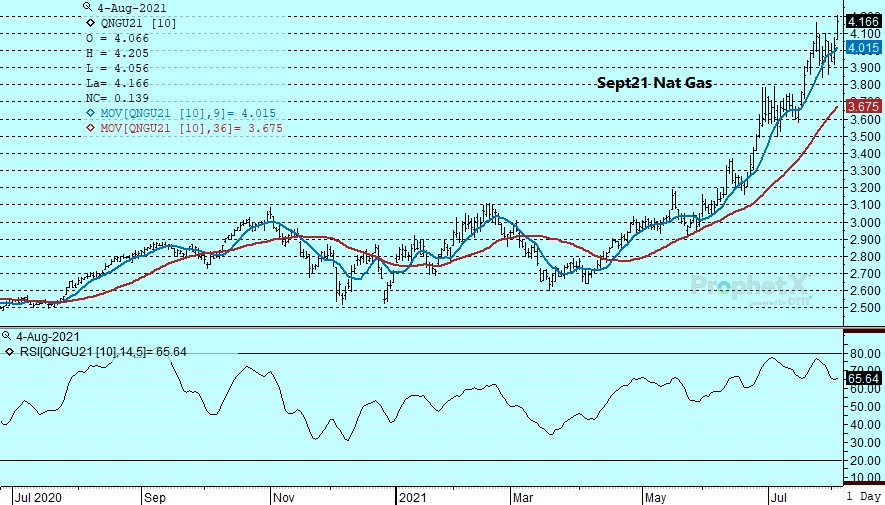

Natural Gas

The Nat Gas traded sharply higher rising by over 14 cents and reaching a new high for the move of 4.207 basis September. Forecasts of hotter temps than previously expected and strength to international nat gas prices encouraging exports of LNG continues to underpin bullish sentiment at a time when Nat Gas production levels are relatively stagnant and appears to be prompting concern over winter storage. The EIA report tomorrow is expected to show an injection of 28 bcf compared to the 5 year average of 30 bcf. With the incentive to export strong due to record high global prices and demand likely to be supported by the warmer weather forecasts encouraging higher electrical usage, ongoing tightness is likely to continue and might extend the rally. The move through the recent highs at 4.165 could signal a test of the 4.40 level in the intermediate term on the prospect for a tighter supply outlook with good support near 4.03-4.05 basis September.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.