Price Overview

The petroleum complex consolidated yesterday’s strong gains before settling slightly higher on the day. Pre-weekend book squaring and profit taking appeared to limit buying interest. The drawdown in inventories and potential for a supply deficit to develop continues to provide underlying support. In the background is recent dollar weakness which has discouraged overhead selling.

The crack spreads continue to be well supported. Stocks of both gasoline and distillate have seen a declining trend as demand expands despite the rising infection rates. The appearance that new fiscal stimulus and additional measures to encourage vaccination will be enacted is helping provide support.

Crack spread valuations are still reasonable despite the strong advances since late last year. We see tightness in refining capacity and expansion in demand underpinning margins for both gasoline and diesel relative to crude oil where international considerations play a larger role with respect to OPEC+.

Natural Gas

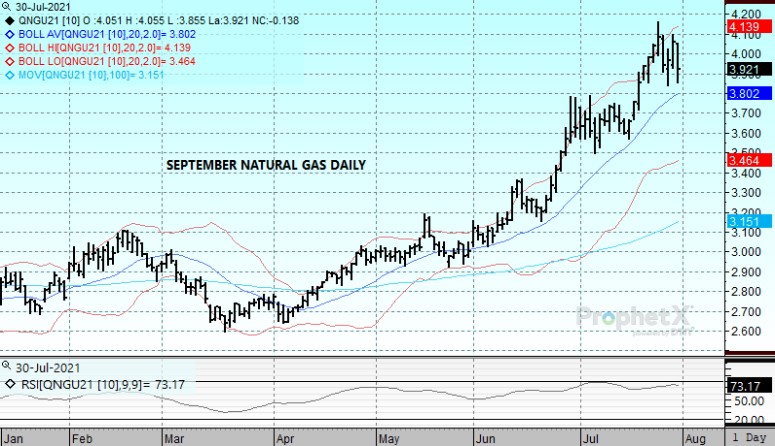

Prices came under considerable selling pressure today as the September contract lost 14 1/2 cents to settle at 3.914. The reversal erased yesterday’s action which had produced solid gains following the weekly storage report. The 36 bcf injection was below estimates at 43, and seemed to surprise the market after the previous two weeks of builds had been above expectations. The response to the report appeared overdone and the majority of the gains were relinquished by early this morning as weather models saw a decrese in CDD expecatitions. Concerns regarding maintenance on the NGPL pipeline that supplies the Sabine Pass LNG terminal also garnered selling interest, although it appeared likely that supplies could be rerouted if the outage time was extended. For now LNG flows appear unaffected as they have been consistently near 10.8 bcf/d for over a week. The break was unable to penetrate Wednesday’s lows as the 3.80 area offers solid support. A move through the recent highs at 4.165 could signal a test of the 4.40 level.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.