Price Overview

The petroleum complex traded near unchanged levels following sharp declines registered over the past few sessions. Ideas that OPEC+ has reached a compromise that will allow the UAE to receive a higher baseline after the current agreement expires in April has helped limit selling interest as the market gauges supply/demand scenarios. While some concern remains over growing Covid cases in Asia, the strength in many OECD economies and the recovery of demand in the US and Europe is supporting values as current production levels continue to fall short of demand and lead to declines in inventory levels, particularly in the US. Expectations that production in non-OPEC areas will continue to be curbed as capital investment is restrained remains in the background as a supportive influence.

In the near term, a slowdown of growth in China and India might contribute to ideas that the chances for global growth to exceed expectations is limited. The decline in Indian import levels for June to their lowest in nine months magnifies these concerns, but with mobility rates increasing a recovery is expected in the coming months. The OPEC Monthly Report released yesterday indicated a global deficit of 1.58 mb/d during the second quarter of 2021 based on demand of 95.32 mb. In addition, they forecast global demand reaching 98.24 mb in the third quarter and 99.82 mb in the fourth quarter, suggesting further stock draws of as much as 2 mb/d. An OPEC ministerial meeting in August should address the outlook for oil supplies into 2022. There are growing concerns that due to the compromise with the UAE, other producers might want some upward revisions in their baselines as well.

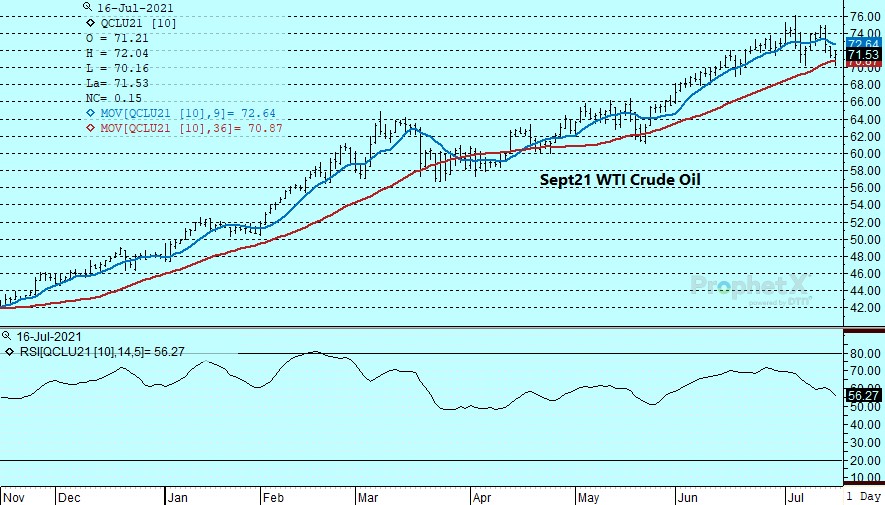

Given the uncertain supply/demand outlook, support near 70.00 basis September crude should hold, while resistance in the 75.00-75.50 range will be formidable. Further declines in inventories above expectations could lead to a retest of the 76.50-77.00 area.

Natural Gas

Yesterday’s storage report put additional pressure on prices as the 55 bcf build was above expectations at 47 and the 5 year average of 54. Follow through was evident overnight as the market put in new lows for the week before recovering during the day session. The weather continues to lack excitement as temperatures hover near normal levels in the 15 day forecasts. Despite the negative influences, the market managed to settle over 6 cents higher today at 3.664 basis September, which was nearly unchanged on the week. Volume was light as short covering ahead of the weekend helped support prices. LNG exports continue to underpin the market as they have held near 11 bcf/d recently. Production has remained unpredictable, but recent inklings of recovery could further pressure prices in the absence of weather demand. The market has been fairly resilient thus far in the face of normalized temperatures, but heat will have to return if the highs near 3.80 are going to be retested this summer. Further weakness should find initial support near today’s lows at 3.57, while the 3.47 level would likely hold up to a stronger selloff as it marks a 50 percent retracement of the rally since mid-June.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.