GOLD / SILVER

The gold and silver markets enter the Tuesday trade under pressure because of a slightly positive dollar and residual concerns of how the US Federal Reserve (Powell testifies to Congress on the virus today) could manage inflation and allow significant improvement in the job situation. It was somewhat impressive to see gold and silver hold up in the face of suggestions from the Fed that instead of raising rates the Fed could “alter/increase” the rate of tapering.

PALLADIUM / PLATINUM

While the 3-day high forged overnight certainly puts the bear camp off balance, without a definitive broad-based risk on environment it could be difficult for September palladium to extend the overnight rally above $2600. It should also be noted that platinum ETF holdings last week increased by 18,139 ounces, with holdings on Monday increasing by 4,665 ounces and vaulting the year-to-date gain in holdings up to 8.2%.

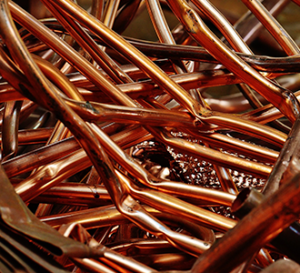

COPPER

Bearish sentiment toward copper continues to escalate with stories overnight suggesting that the Chinese copper market is replete with bears. On the other hand, “Wall Street” overnight appears to be touting a “buy dips” posture. While the copper market managed to reject a downside extension yesterday, we leave the edge with the bear camp, as China announced it would investigate the spot iron ore market for its role in driving up iron ore prices and that suggests China is still in the process of trying to deflate a-number-of input prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.