Price Overview

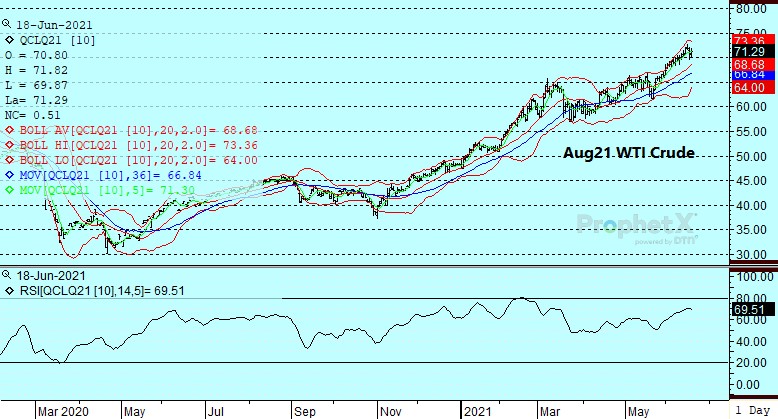

The petroleum complex came under pressure early in the session on dollar strength and in response to reports of progress in the nuclear talks by the chief Iranian negotiator. Good buying interest then emerged just under the 70.00 level basis August as nervousness developed on ideas that a hardliner would likely emerge as Iranian president in the elections taking place today, limiting the scope for compromise, at least initially, in the negotiations. In addition the approach of a tropical storm in the Gulf of Mexico and the shutting down of oil rigs encouraged short covering on ideas that production would be affected in the near term leading to a further draw of crude inventories. With the hurricane season only beginning and forecast suggesting that it will be active, additional threats to output cannot be ruled out. In the background were ideas that the more hawkish approach by the Fed could signify that economic growth projections might need to be revised upward, signaling stronger demand than currently expected.

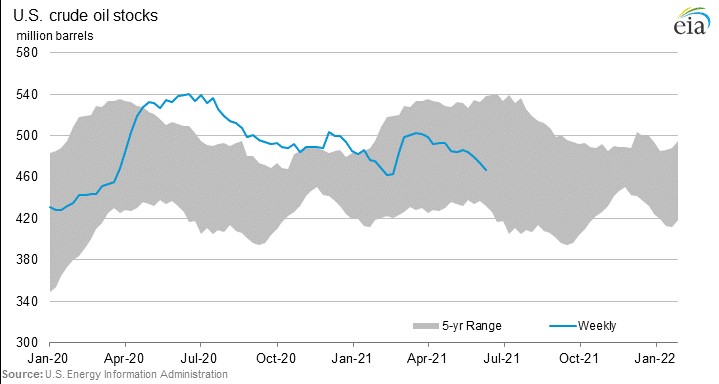

Ideas that global inventories are getting progressively tighter as demand recovers is underpinning the buying interest. How strong the recovery will be, along with the inclination of OPEC to increase output more than currently planned, remain key monitoring points. US crude inventories have declined sharply since April and have fallen into the 5-year range. As demand recovers these stocks will get tighter in terms of days’ supply, which appears to be supporting values. Thursday’s technical OPEC meeting provided forecasts suggesting US production is unlikely to grow more than 200 tb/d this year with growth of .5-1.3 mb/d in 2022 giving OPEC+ pricing power in the short term.

The need for OPEC to expand output as non-OPEC producers appear unable to quickly ramp up output suggests a tightening situation, which will need to be addressed in coming months. In the absence of any action from the cartel to increase production, along with slow progress toward lifting export sanctions on Iran, we believe the market will hold support in the 66.00-68.00 range and move toward the 2018 highs near 76.90 in prompt WTI crude as stocks continue to be drawn down into the summer.

Natural Gas

Yesterday’s lows were tested overnight as the July traded down to 3.166 before ending the session 3.8 cents lower at 4.215. Weakness stemmed from eneventful weather reports and stubborn LNG flows, which remain under 10 bcf/d due to continuing maintenance. A tropical depression in the Gulf had trade on edge but resulted in generally lower price action as the concern over lost production was offset by the potential disruption to LNG facilities as was experienced during last years storm season. The weekly storage report yesterday showed a 16 bcf injection due to a reclassification of 51 bcf by PG & E. The implied flow was 67 bcf, below estimates near 72. The number was unable to ignite much buying interest as the market seems to be waiting on more warming before trading higher. The continual test of the lows points to a possible probe to the 3.135 area, which would mark a 50 percent retracement of the late May to mid-June rally. With production flat and Mexican exports maintaining their record pace, we still expect the market to find further strength this summer as LNG recovers and temperatures rise. The 3.40 level looks to be the markets next upside target.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.