Price Overview

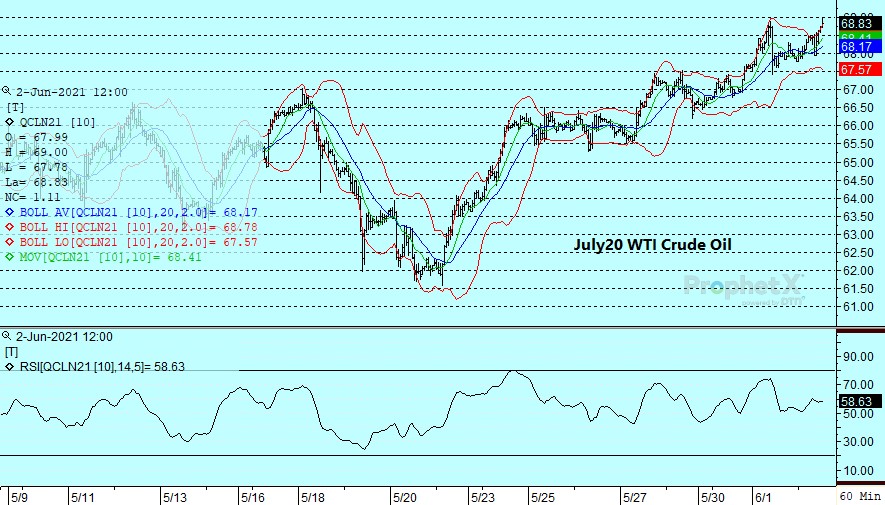

The market continues to surge as OPEC+ stuck by its April decision to gradually return production to the market. There is also growing sentiment that it will take time for Iranian production to recover given the slow pace of the nuclear talks. Rising optimism over economic prospects remain supportive as well, as the long-awaited recovery from the pandemic progresses and travel by air and land picks up dramatically. The improvement in demand made the OPEC+ decision relatively easy as they gradually return production to the market. The meeting that took place Tuesday took only 20 minutes and was the shortest in history, suggesting a lack of derision for current policy and a unified front, showing satisfaction of the members with the markets recovery.

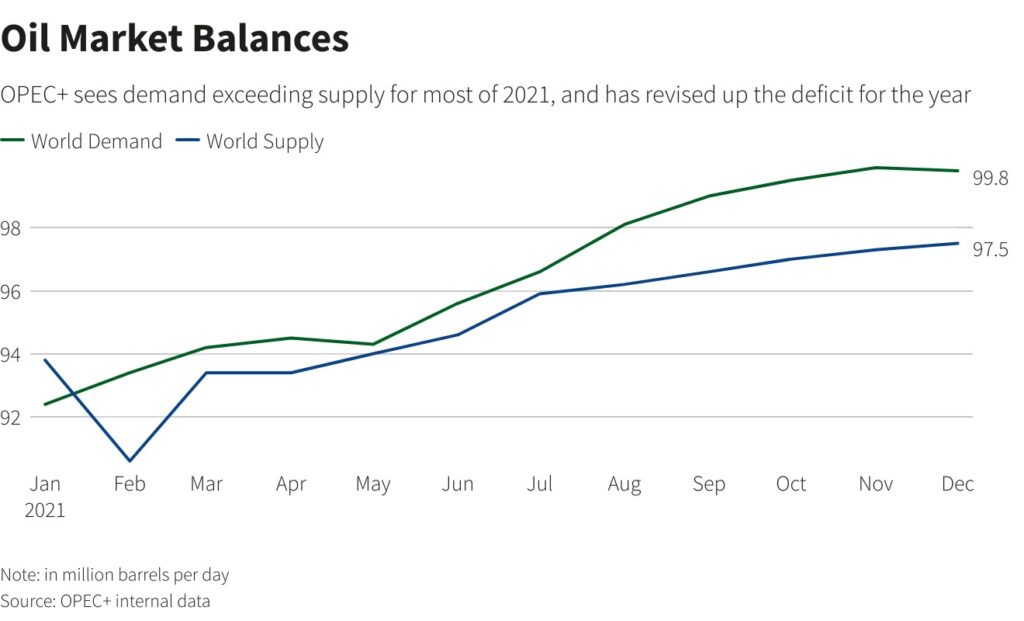

Ideas that demand might be stronger than expected remain in the background, particularly if the Asian pandemic begins to come under control. The supply/demand balance from OPEC looks to be getting tighter than we had expected, particularly if stimulative monetary and fiscal policies are kept in place. As summer progresses a clearer picture of demand trends should emerge as the high prices and widening deficit encourage shifts in global production, as well as discouraging demand.

The DOE report, which will be released tomorrow due to the Memorial Day holiday, is expected to show crude inventories off by 2.1 mb, distillates and gasoline both lower by 1.4 mb, and refinery utilization up by .8 to 87.8 percent.

Natural Gas

Prices eased today after yesterday’s sharply higher move coming out of the holiday weekend. Warmer forecast revisions were again pointed to as the catalyst for the spike up, but fund buying likely played a role as natural gas remains cheap compared to other commodities that have seen substantial price moves recently. Early runs yesterday had also pointed to a sharp drop in production to 89.7 bcf, but that support was erased as late revisions bumped it up by nearly 2 bcf and back into its recent range. The move through 3.05 basis July could indicate a transition to a new trading range as we enter the summer injection season. With LNG reestablishing itself back above 11 bcf/d and exports to Mexico quietly heading to all time high levels, we expect the bias to remain to the upside. The mid-May highs near 3.20 look like the next upside target with the 3.00 area likely marking the low end of the range. Tomorrow’s storage report is expected to show a 95 bcf build which is in line with the average for this time of year at 96. Recent difficulty with estimate accuracy brings the potential for volatility following the release, but we would expect the suggested range to hold up.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.