Price Overview

The favorable demand environment and strength to economic activity in OECD countries generated good buying interest early in the session, as values reaching new post-pandemic highs of 67.52 basis the July crude, but failed to surpass the high of 67.98 on the active contract reached in early March. Selling developed late in the day on the lack of follow through, as both gasoline and heating oil failed to reach new highs suggesting the movement in crude was likely related to the upcoming Ministerial Meeting on June 1st. Expectations are for OPEC+ to stay the course of tapering production cuts. With global economic growth continuing to expand and improving refining margins expected to lead to higher throughput, the potential for inventories of crude to continue their decline appears to be supporting values. The potential that Iran will return as much as 1 mb/d of crude to the market continues to create nervousness.

A further advance of values toward the 68.00 level basis July appears plausible. The movement on a new US budget package, with large increases in spending along with the recovery in the economy continues to underpin demand forecasts. The crude market will still be sensitive to the OPEC meeting, where an unchanged course has been priced in. Overhead resistance might emerge linked to ideas that Chinese economic activity, along with their crude import levels, might begin to show signs of stalling as tighter credit policies and crude import quotas are watched for signs of slowing Asian demand. Any progress of the Iranian nuclear negotiations could also add resistance.

Natural Gas

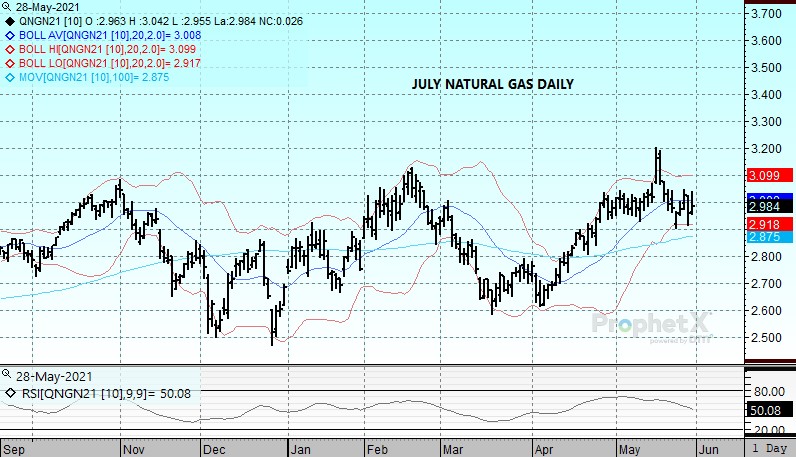

A high side surprise on the weekly storage report yesterday pushed the market back down to a test of support in the 2.90 area basis July. The 115 bcf build was well above estimates at 104 and quickly sent prices to an intraday low of 2.914 before they clawed back some of those losses late in the session. The price recovery continued today without any substantial fundamental driver. Support was garnered from LNG flows surpassing 11 bcf/d for the first time in two weeks as trade anticipates a return to maximum levels. An expected warm up in the 7-14 day period also put a bid under the market as we exit the shoulder season and weather moves back into focus. The second test of the 2.90 level solidifies it as an important support area as we move into summer. Resistance near 3.05 has been tested multiple times as well, and a settlement through that area could portend a move back up to the mid-May highs. The upward bent will be contingent upon warmer temperatures developing into the second half of June and the continued recovery of LNG flows above 11 bcf/d.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.