GOLD / SILVER

While gold and silver have started out on a weaker footing today the markets should find support from news that gold ETF holdings increased for the 8th straight session yesterday, with the chain of inflows the longest since January 6th. Silver ETF holdings also increased by 240,647 ounces and are 3.7% higher on the year.

PLATINUM / PALLADIUM

With the palladium market flaring to a 4-day high yesterday and promptly reversing course and starting out under pressure this morning, a temporary top might have been put in place. The world platinum market is slightly smaller than the world palladium market at 8 million ounces, but a private consultancy forecast calling for a deficit of only 68,000 ounces in platinum is still discouraging to the bull camp.

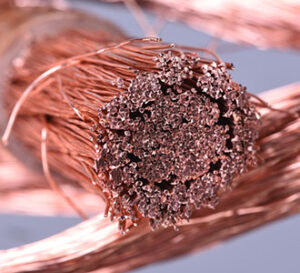

COPPER

Obviously, the broad-based risk off environment has contributed to the weakness in copper overnight with prices this morning matching 8-day lows. While the weakness in equities and fears of higher rates to control inflation are the primary bearish forces operating in the copper market, we also suspect that Chinese efforts to deflate soaring industrial material prices is adding to the downside tilt. In fact, coal futures, zinc futures, iron ore, and steel prices have corrected and in turn provided spillover pressure to copper prices early today.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.